Heartland Bank Reverse Mortgage app

How to get started

1

Request login details by calling us on 1300 889 338. Your login details will be the same whether you’re using our app or logging in from your internet browser.

2

Download the app from

Google Play

or the

App Store

.

Or open Reverse Mortgage Internet Banking from your internet browser.

3

Log in using the login details provided by us. And you’re ready to go!

Manage your accounts online with our app how-to guides

View our how-to guides to see how you can access information about your reverse mortgage on the go and manage your finances wherever you are.

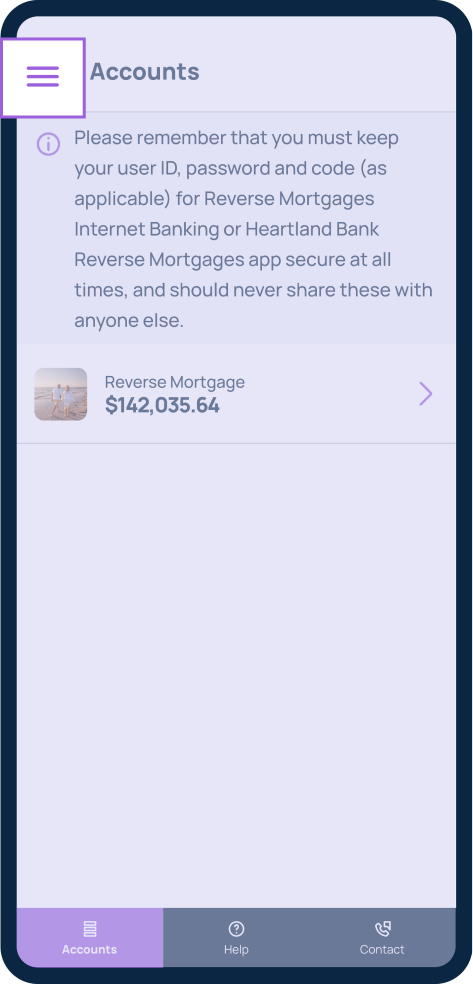

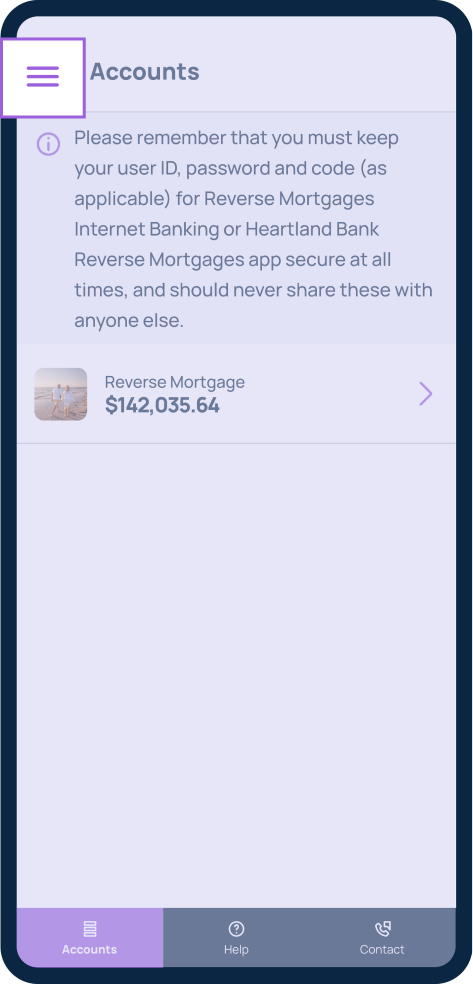

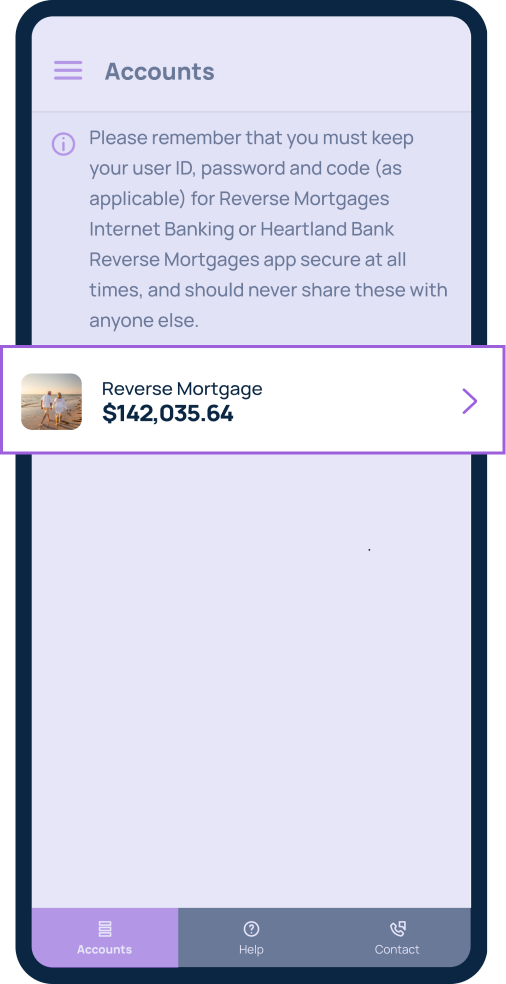

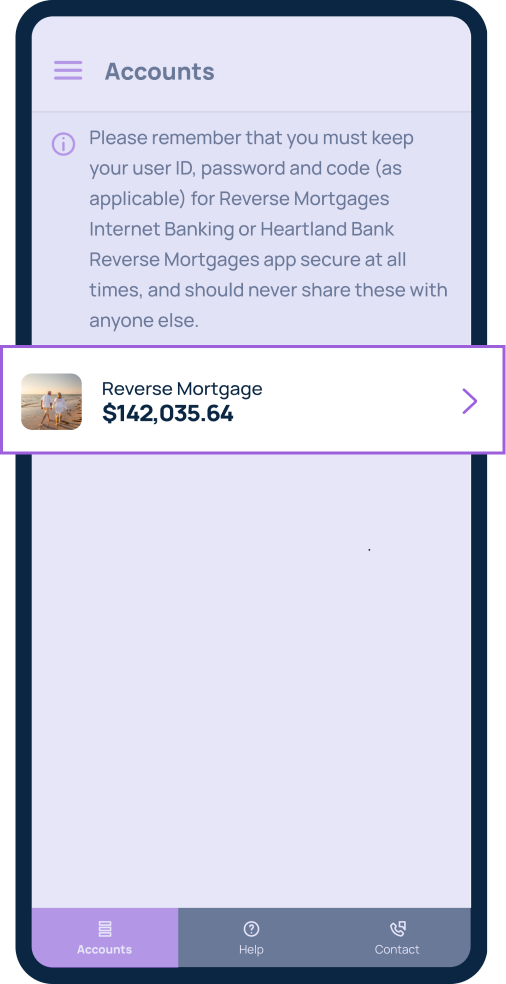

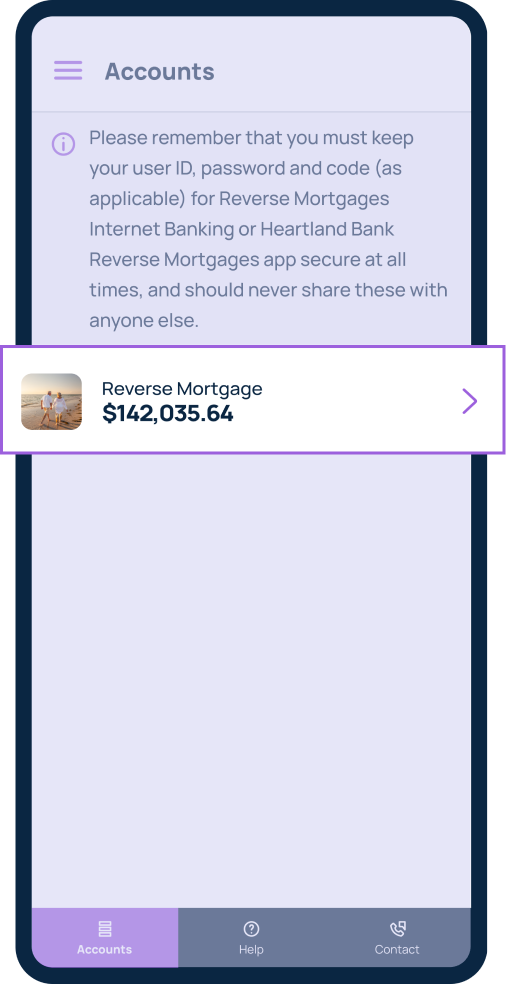

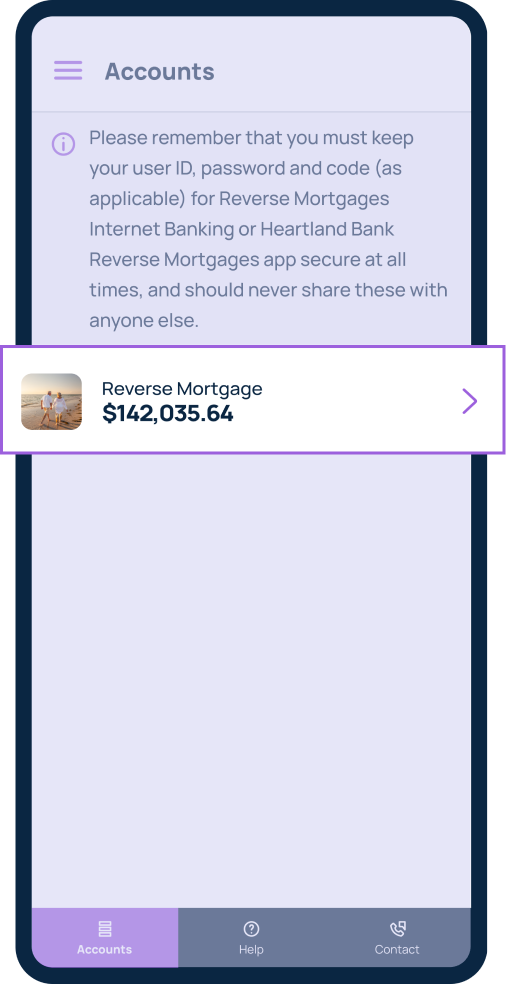

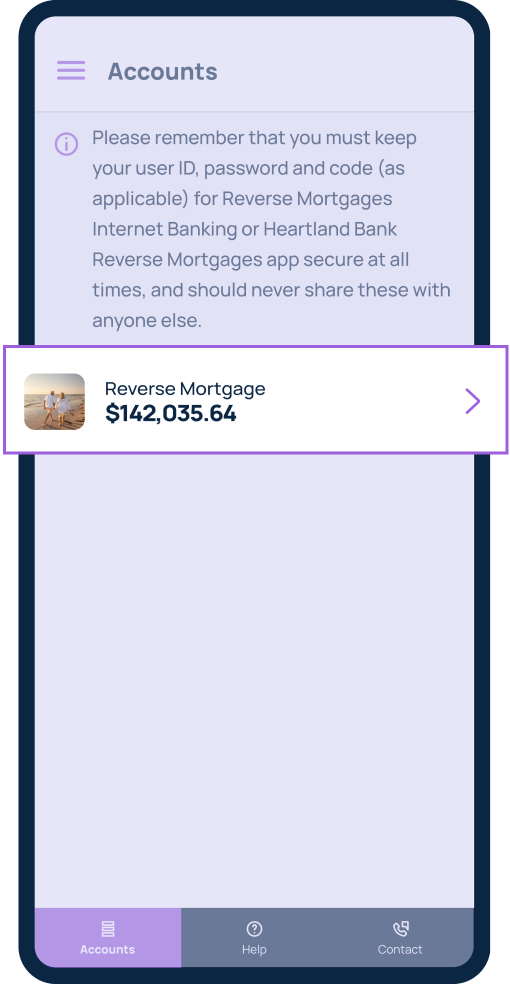

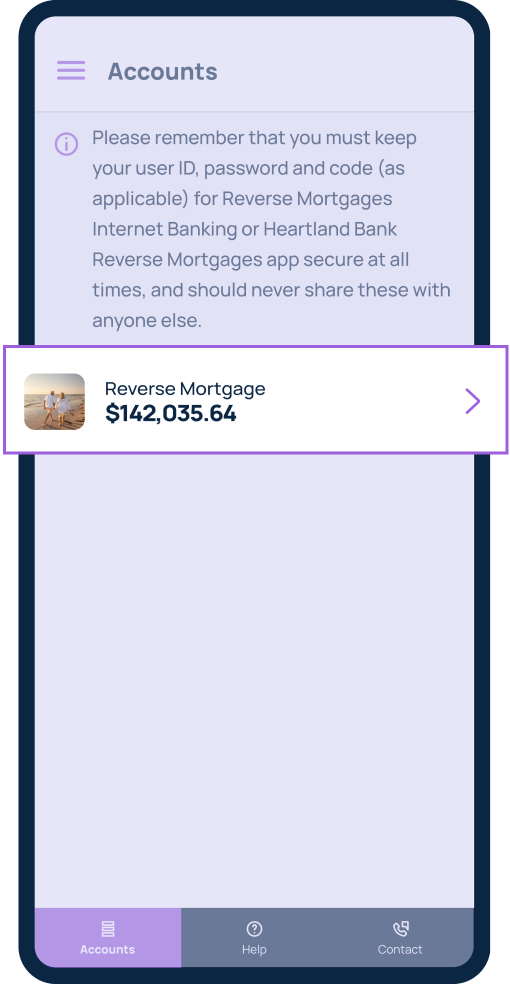

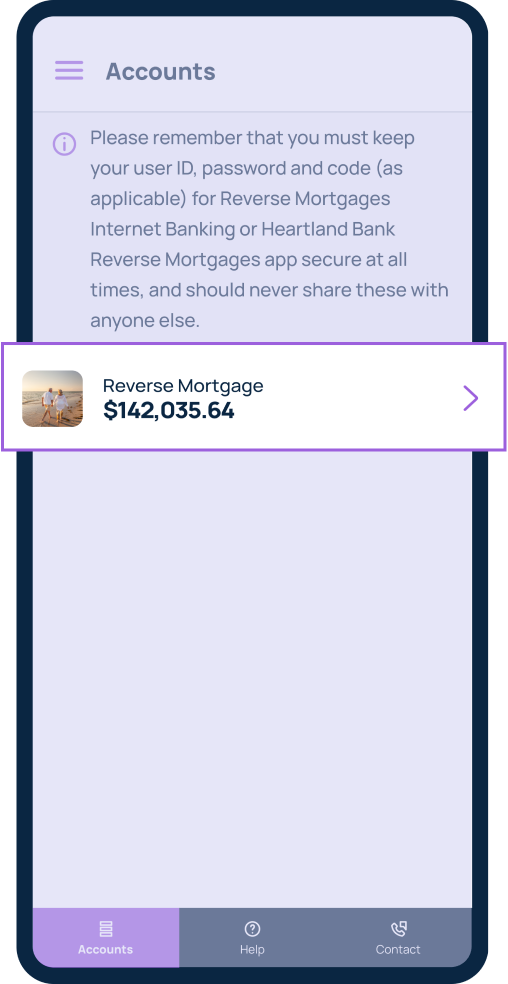

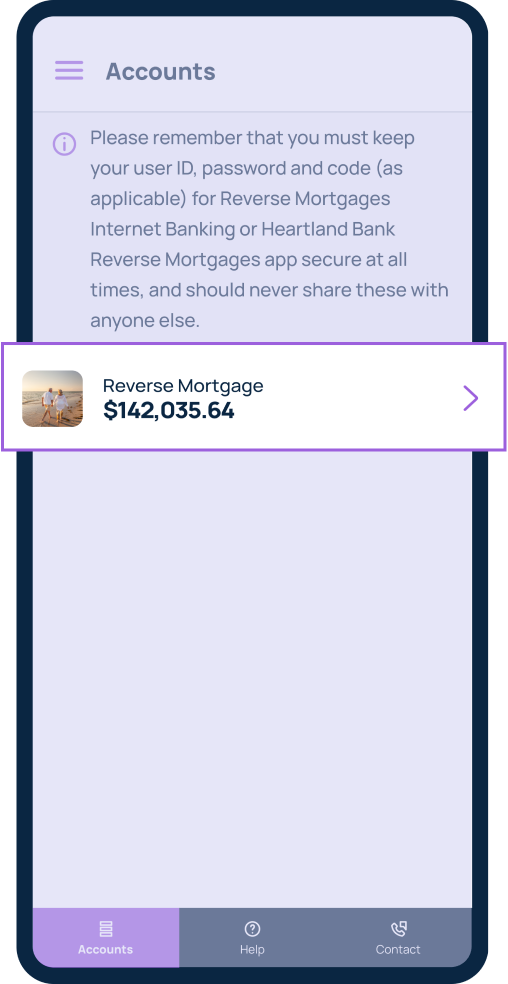

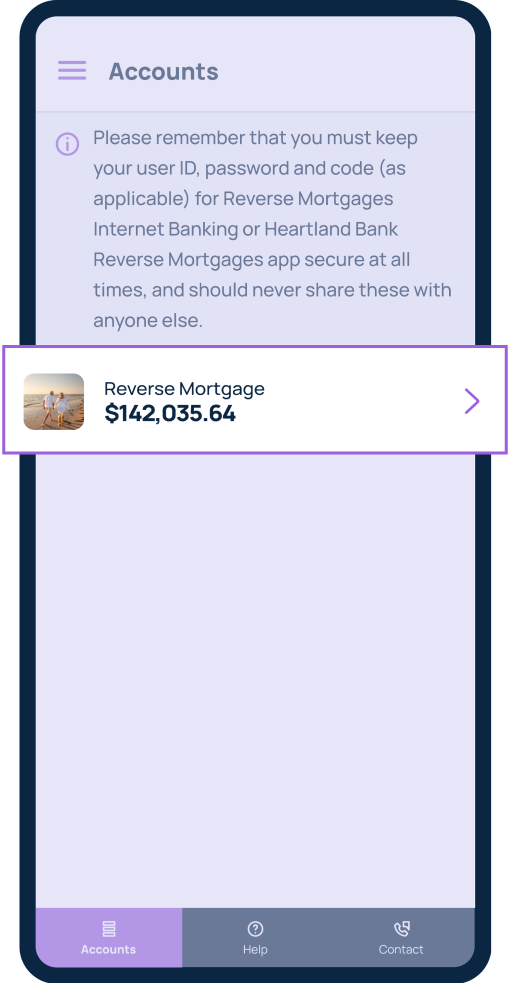

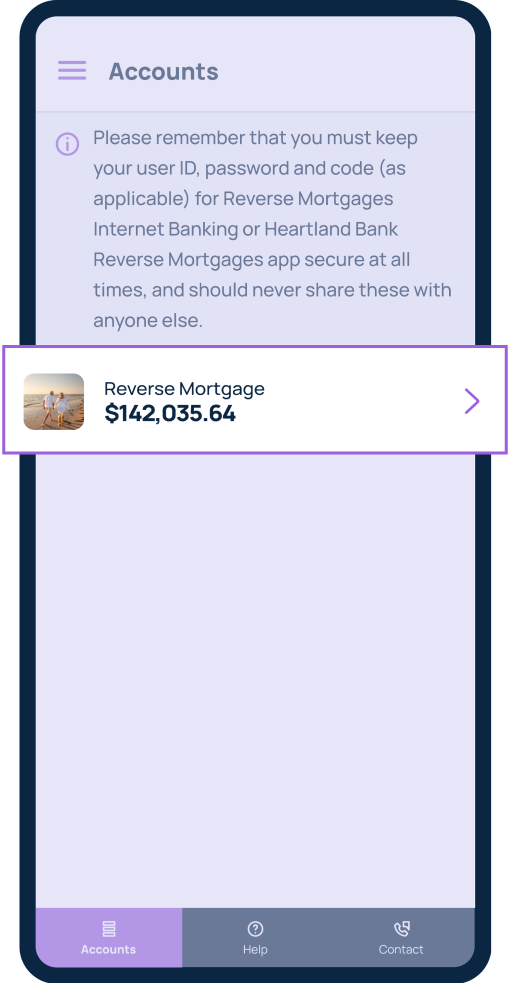

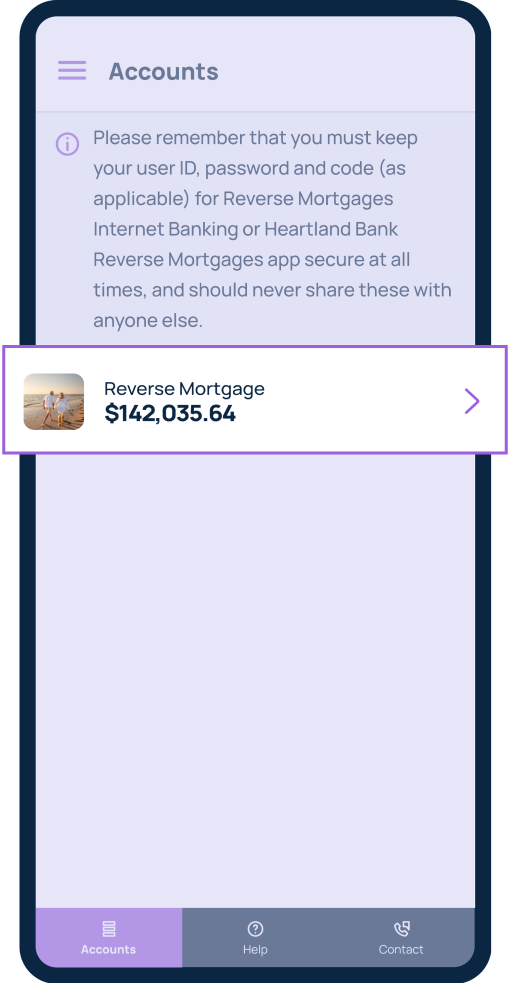

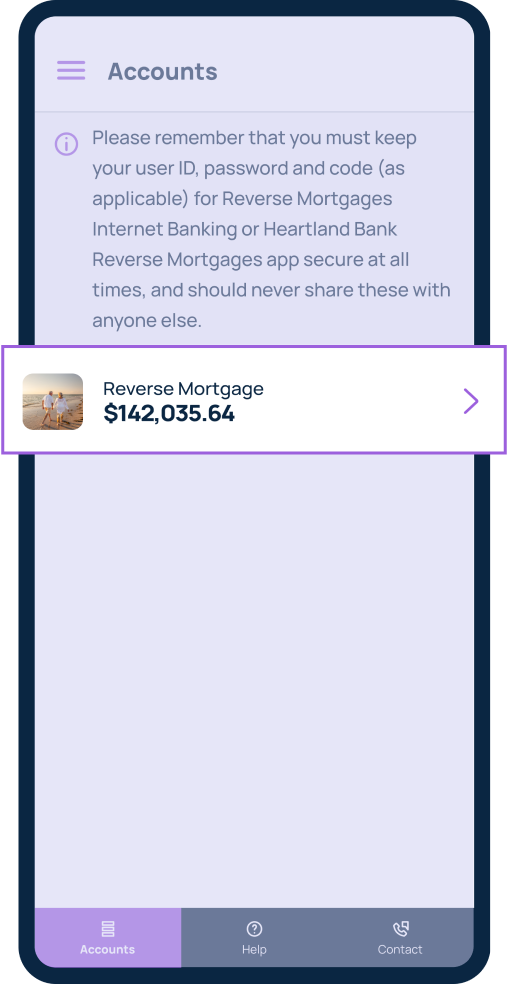

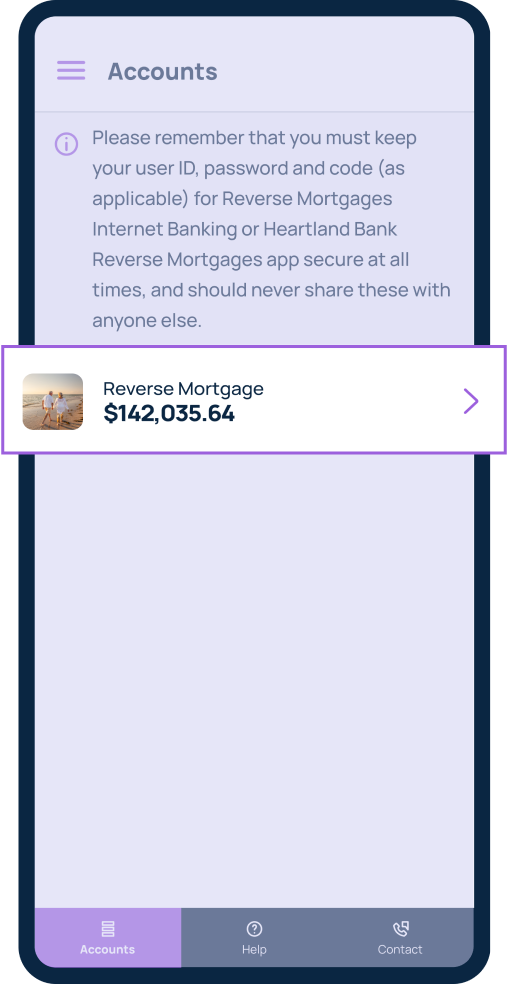

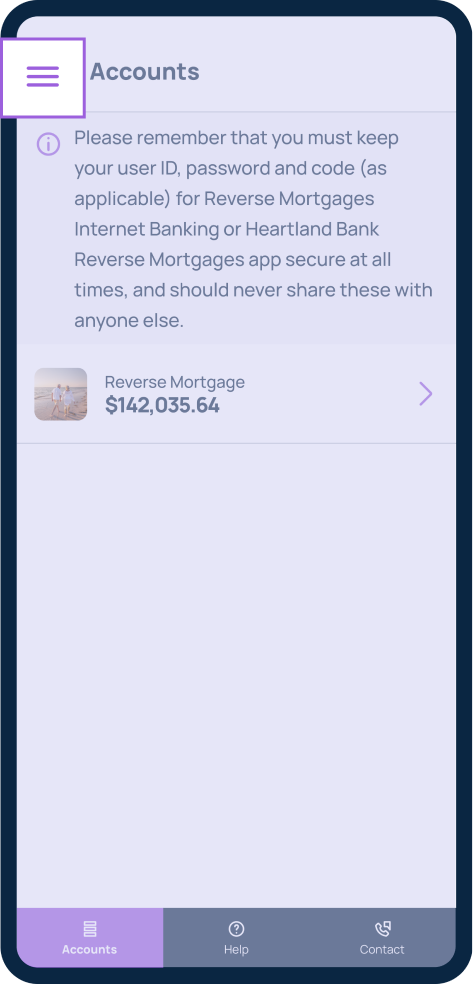

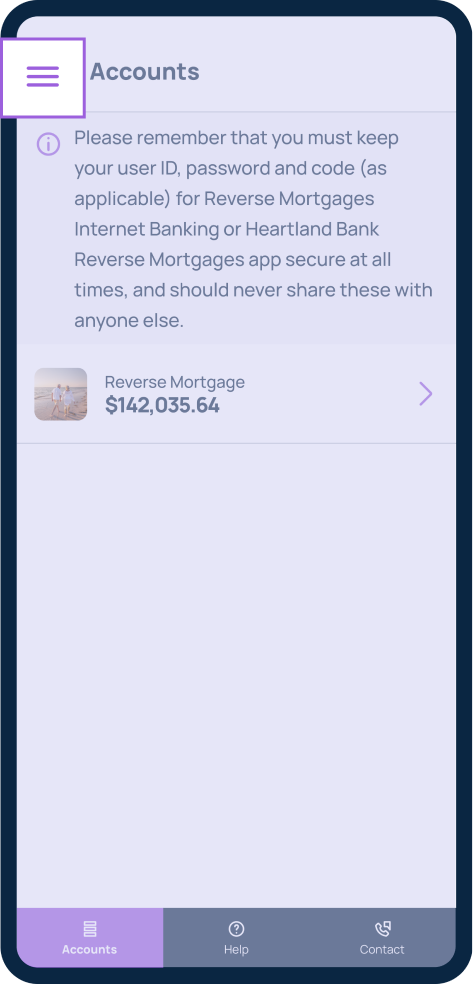

Check your loan balance

Check your loan balance

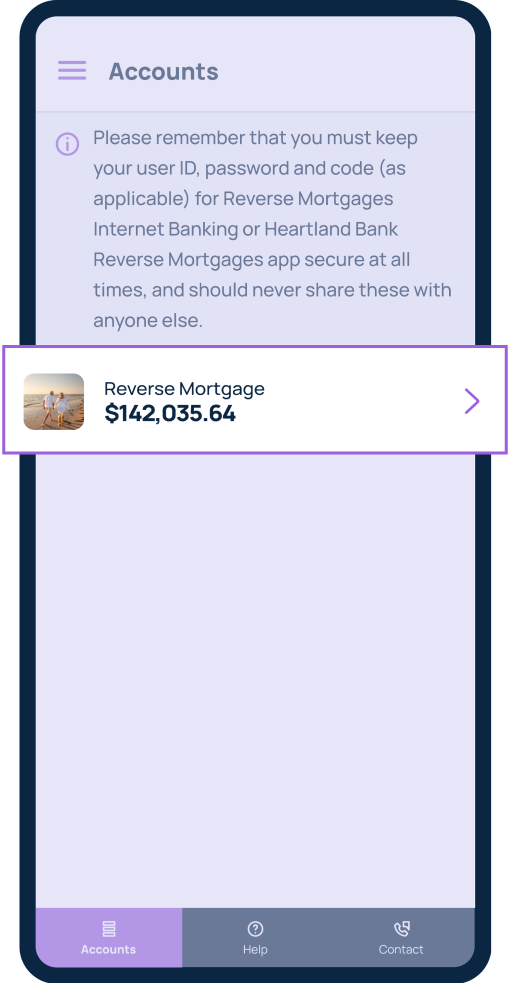

The 'Accounts' page displays your Heartland Reverse Mortgage Loan balance.

By clicking on an account, you can view a more detailed summary.

Please note, transactions which have occurred in the past five business days may not yet be displayed.

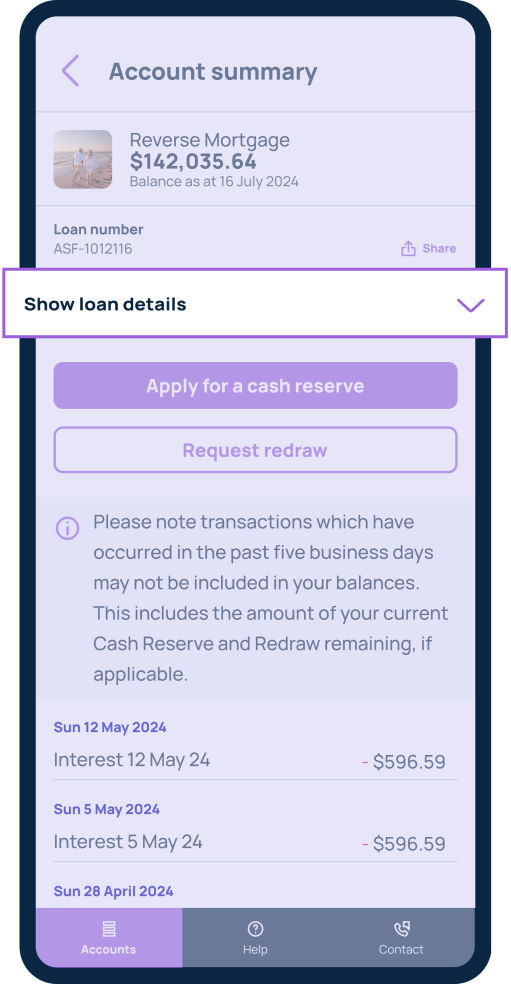

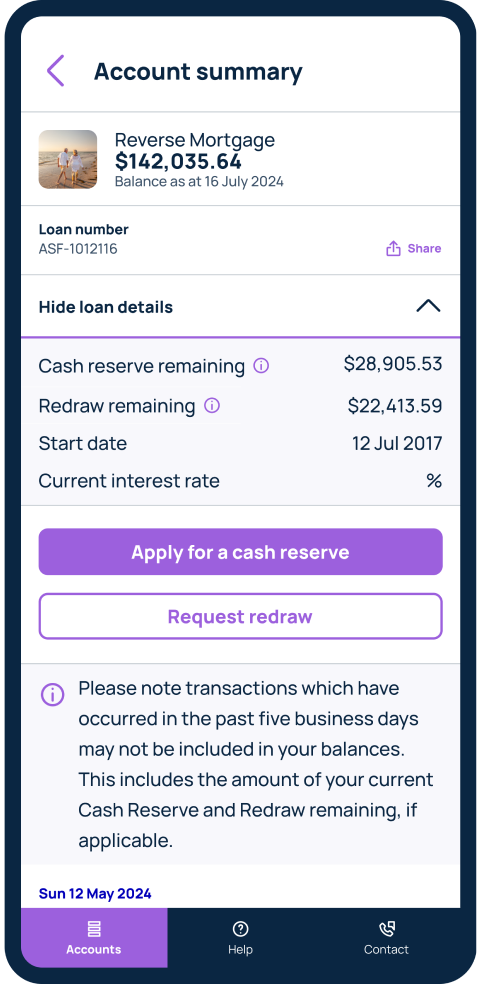

View your loan details

View your loan details

Within your loan account, click 'Show' next to 'Loan details'.

Here you can see the day your loan settled, your current interest rate and your loan number.

Please remember – your loan number must be used as a reference when making any voluntary loan repayments!

Please remember – your loan number must be used as a reference when making any voluntary loan repayments!

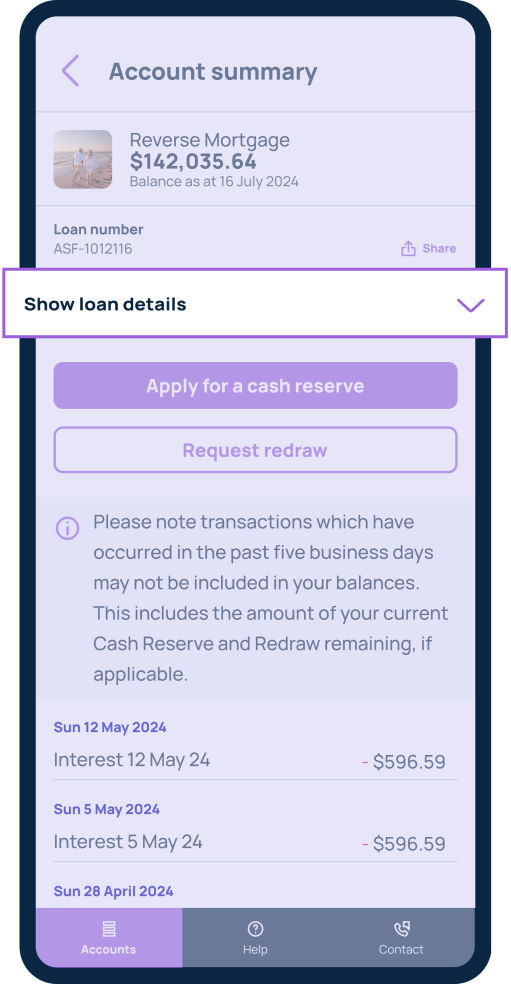

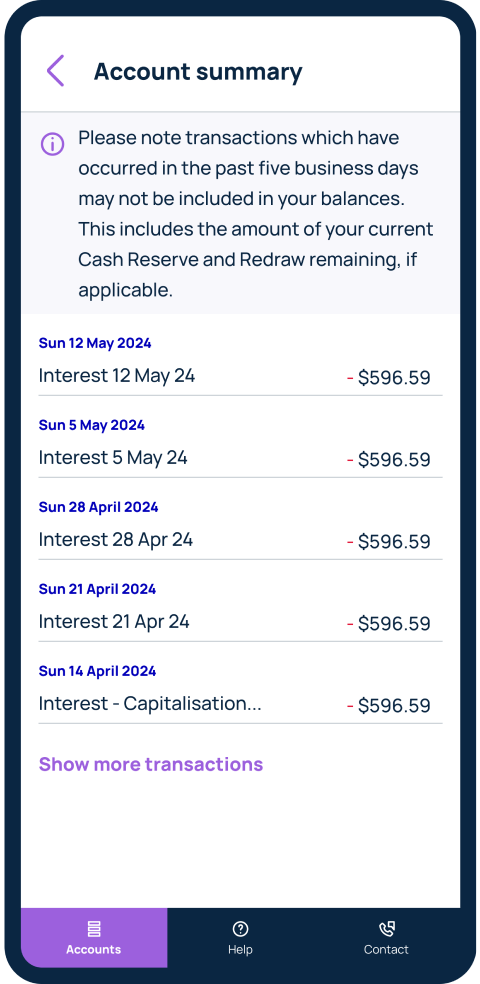

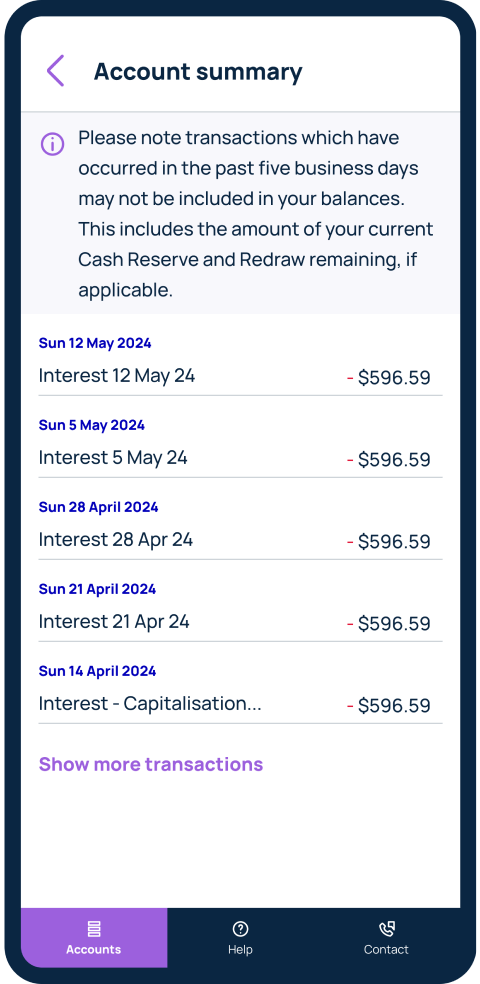

View your loan transactions

View your loan transactions

Within your loan account, scroll down to see a list of your most recent transactions.

At the bottom of the page, there's a button to 'Show more transactions', which will allow you to see further transactions for that account, if applicable.

If you are looking for older transactions that cannot be displayed, you can request historical loan statements by emailing [email protected].

If you are looking for older transactions that cannot be displayed, you can request historical loan statements by emailing [email protected].

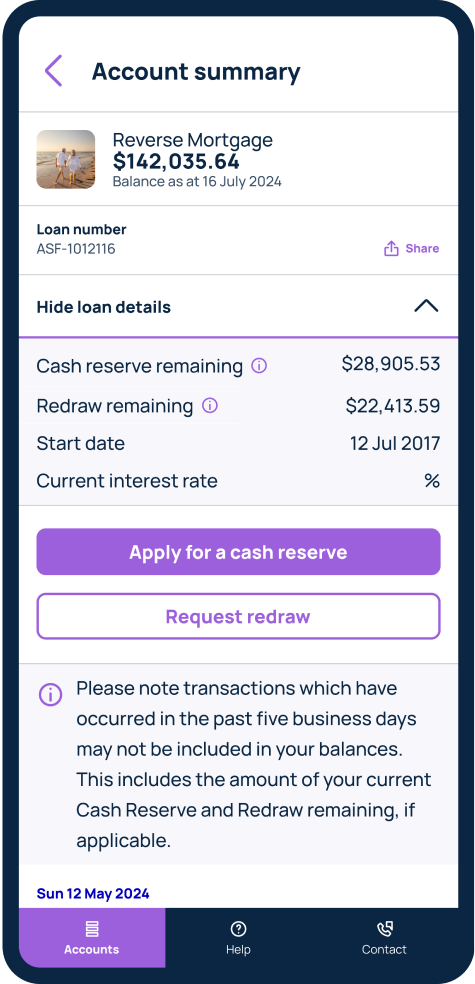

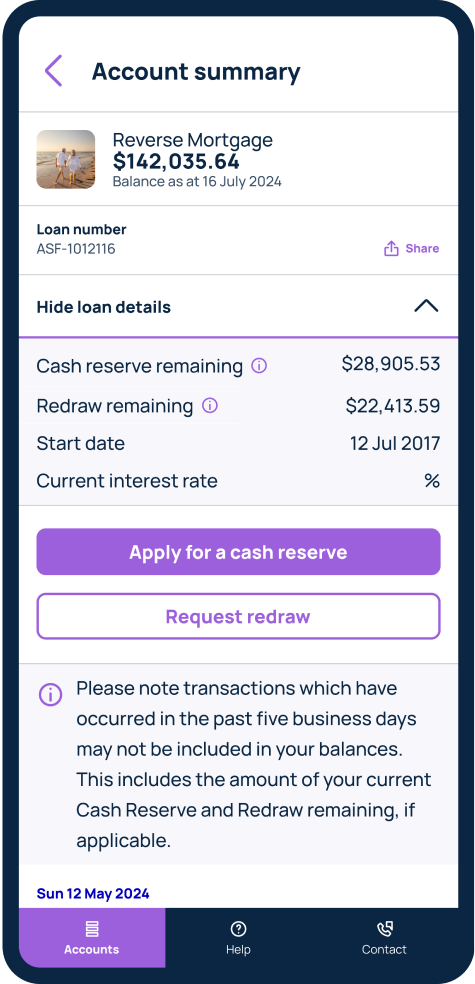

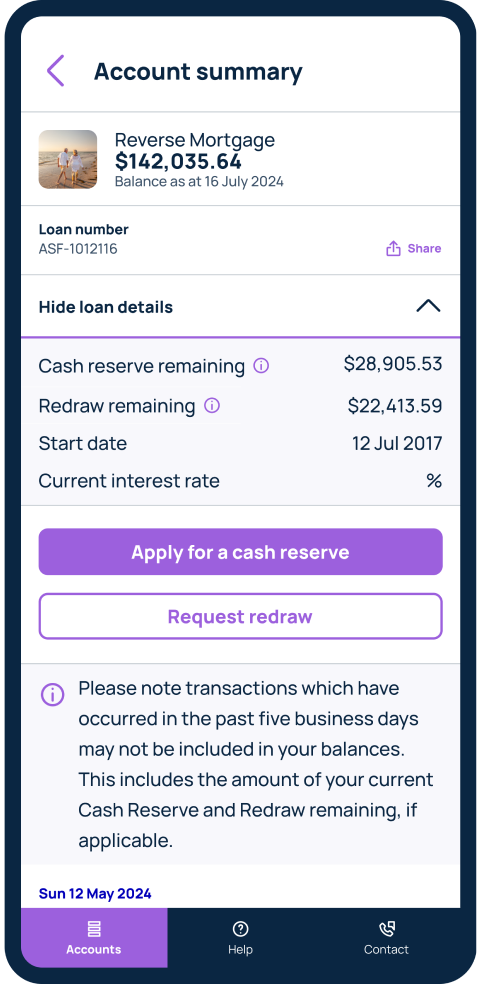

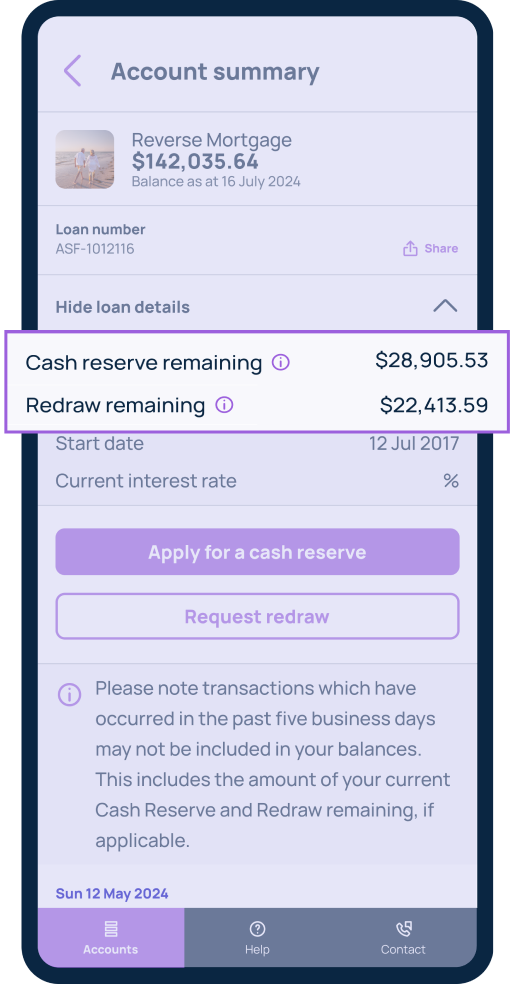

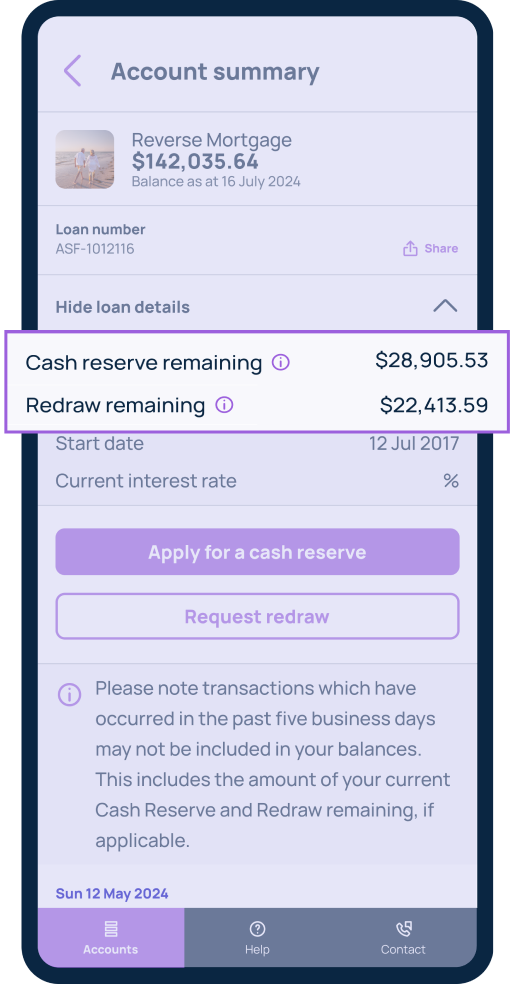

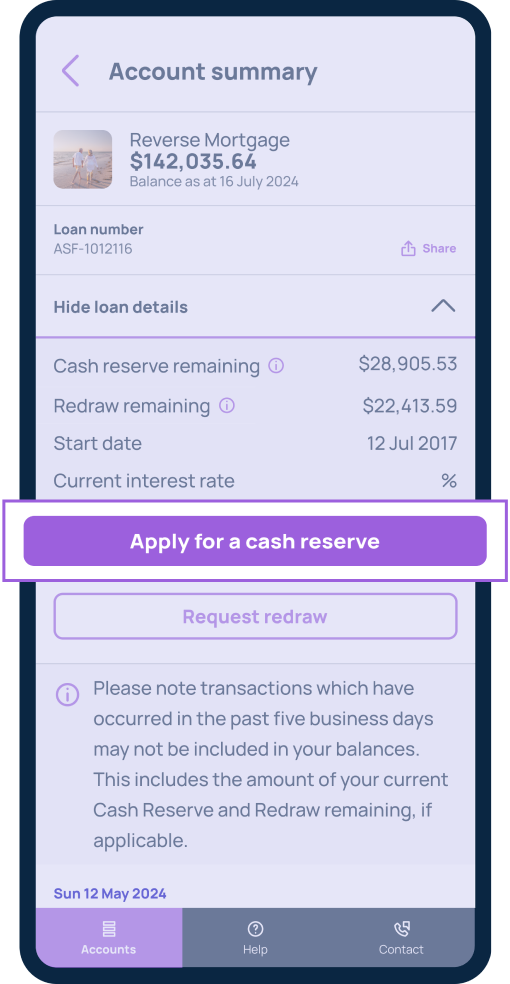

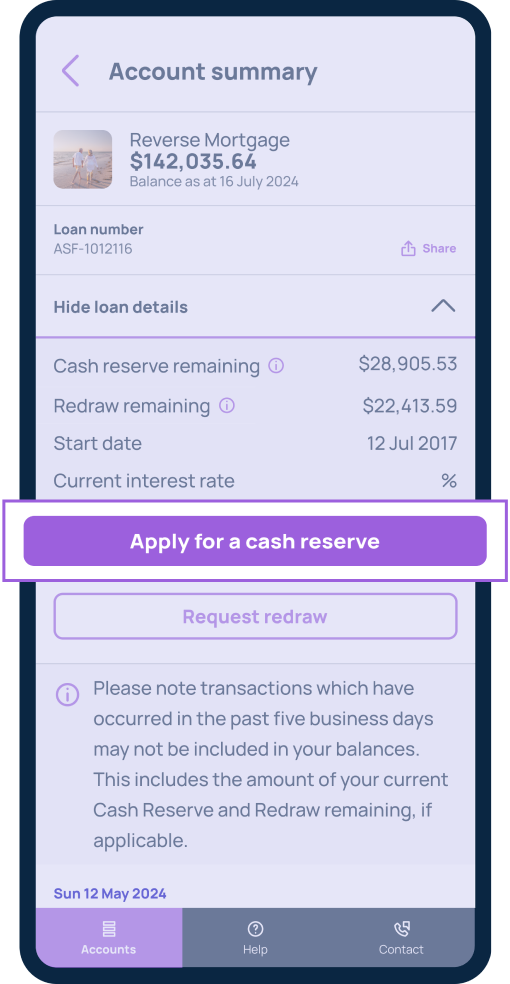

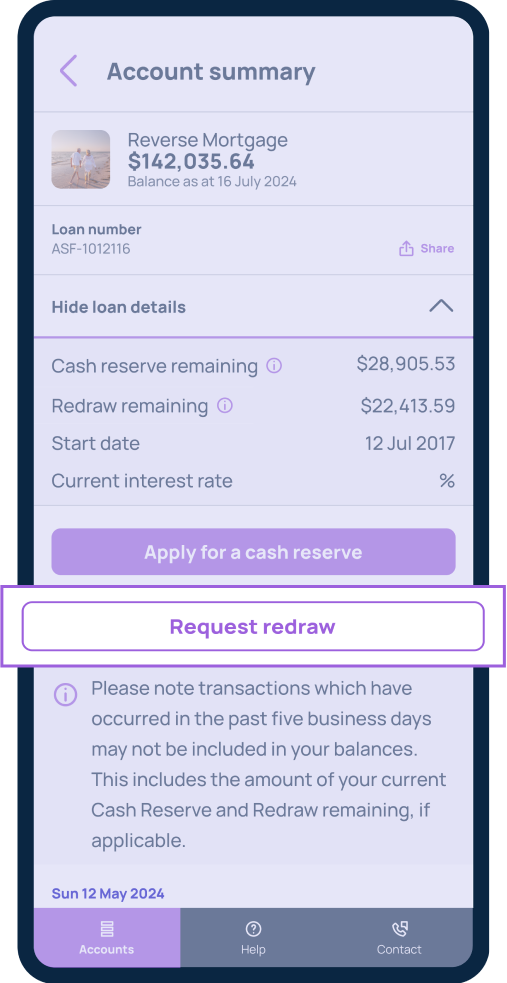

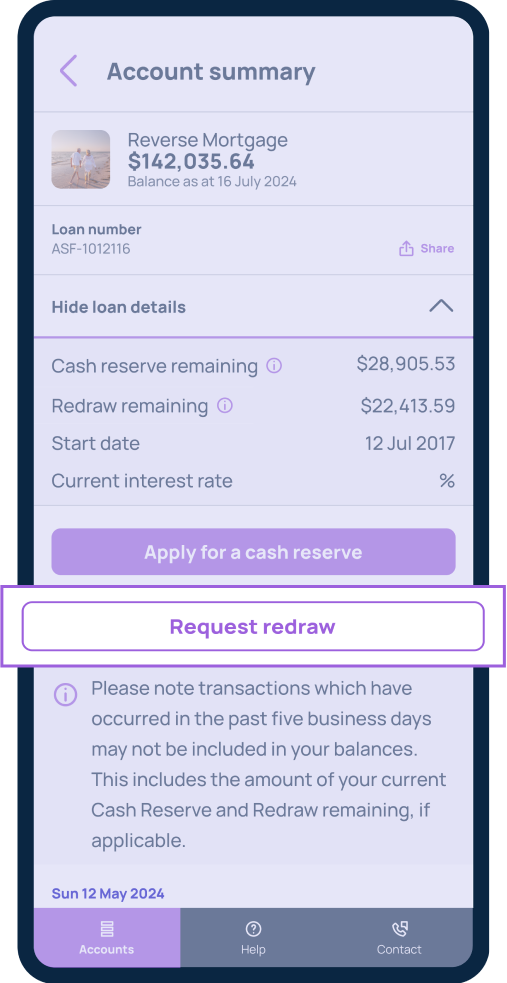

Review your remaining cash reserve and redraw balances

Review your remaining cash reserve and redraw balances

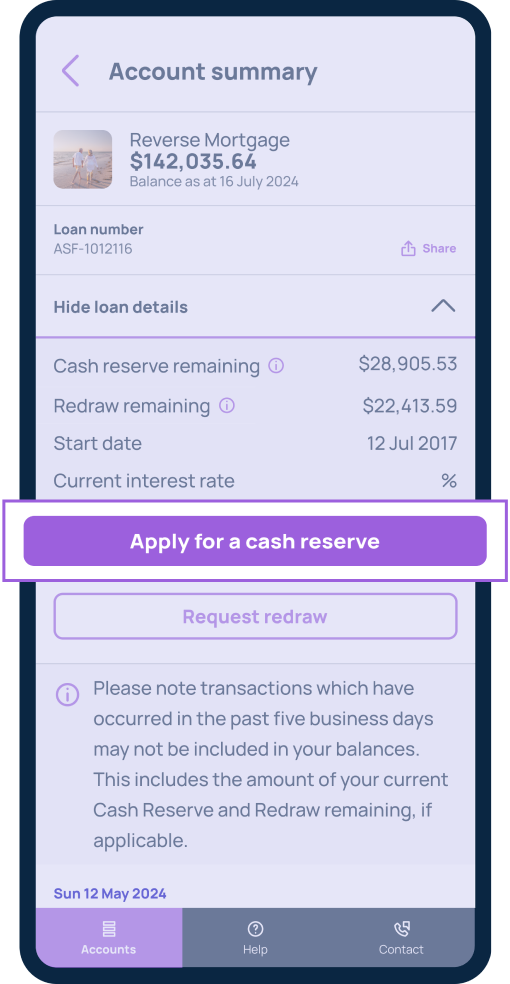

Within your loan account, below your loan balance you will see any remaining cash reserve and/or redraw, if applicable.

Please note, transactions which have occurred in the past five business days may not yet be included against the available amounts.

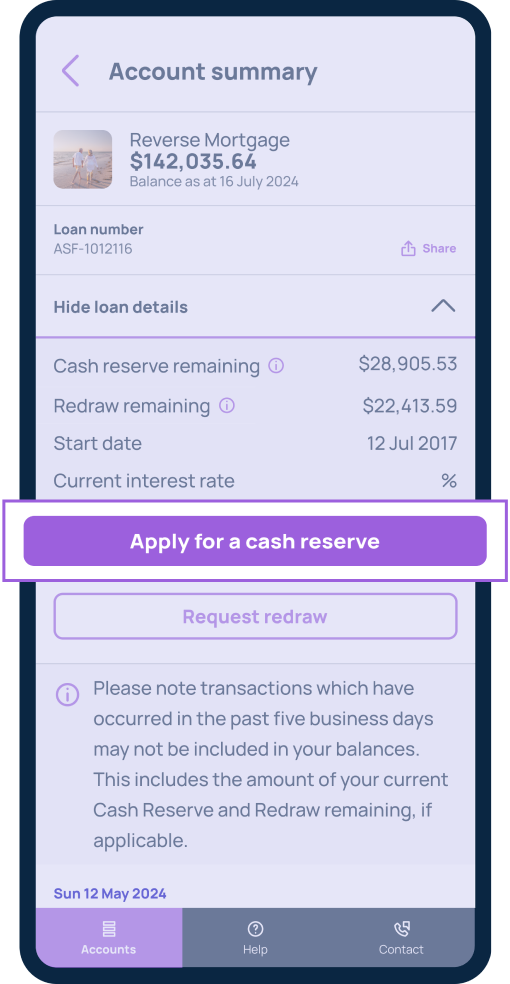

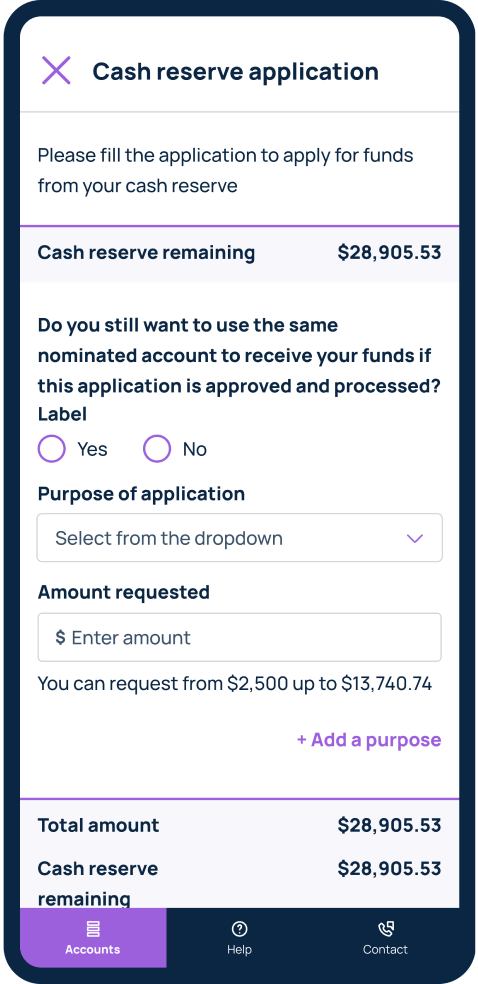

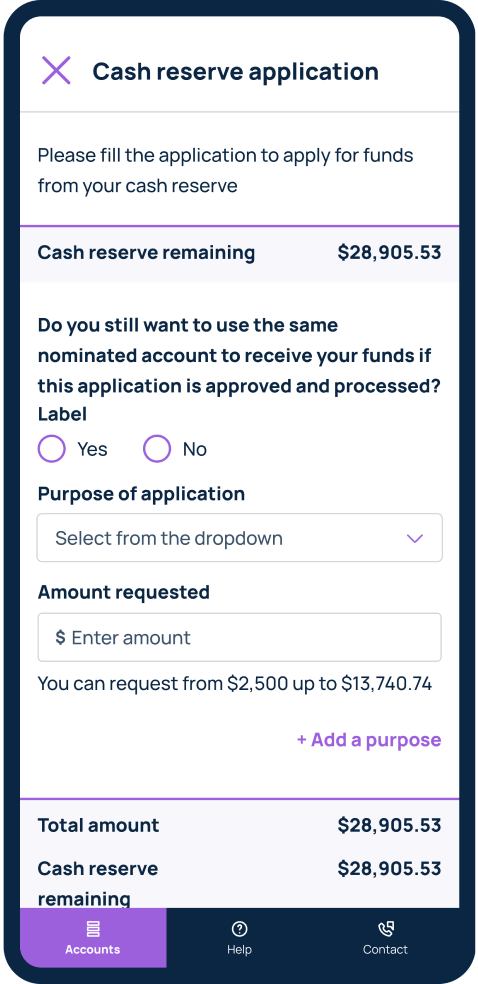

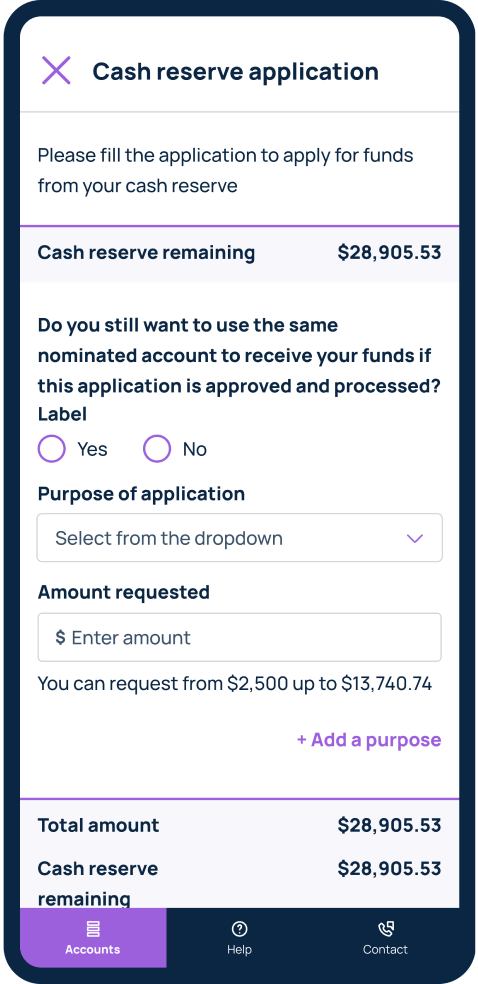

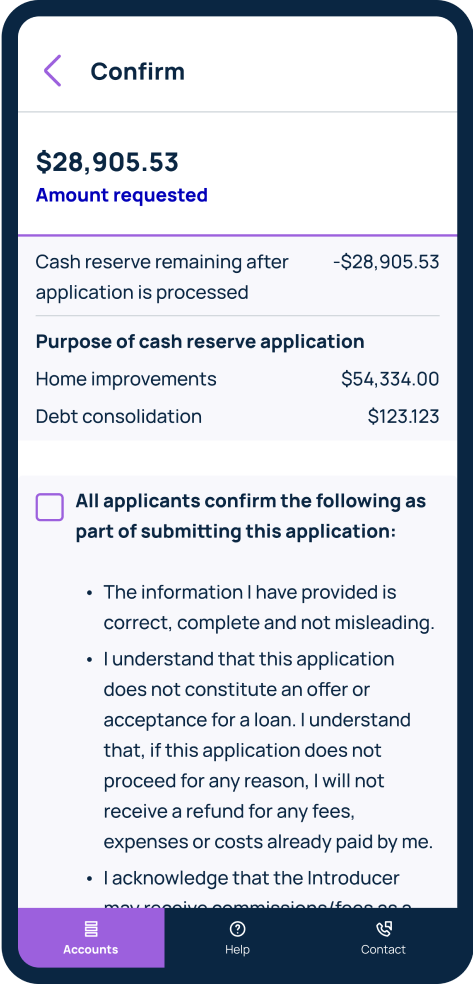

Apply for cash reserve

Apply for cash reserve

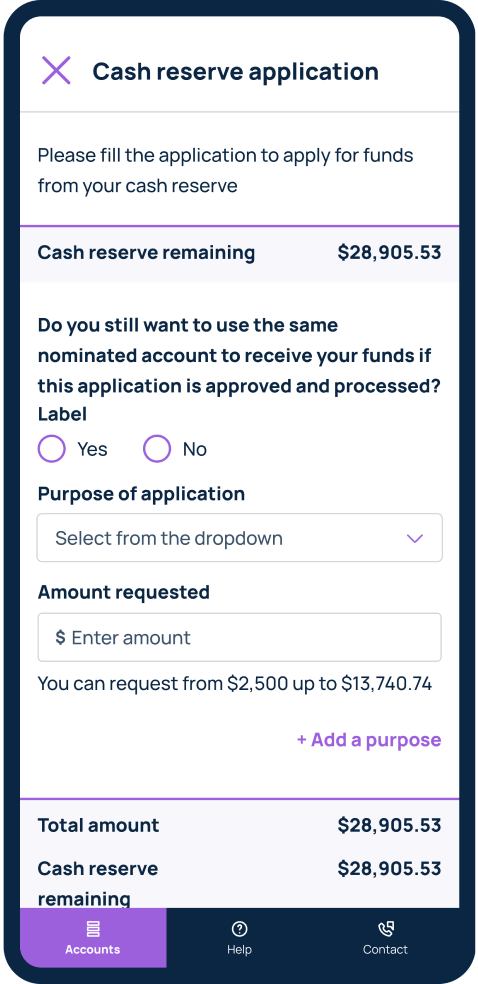

Within your loan account, a button to apply for your cash reserve will show below your loan details.

Click on this button and follow the application questions including confirming your nominated account, purpose of request, and any change to your financial circumstances.

Ensure you have clicked on and agreed to the Privacy Statement and

Privacy Policy.

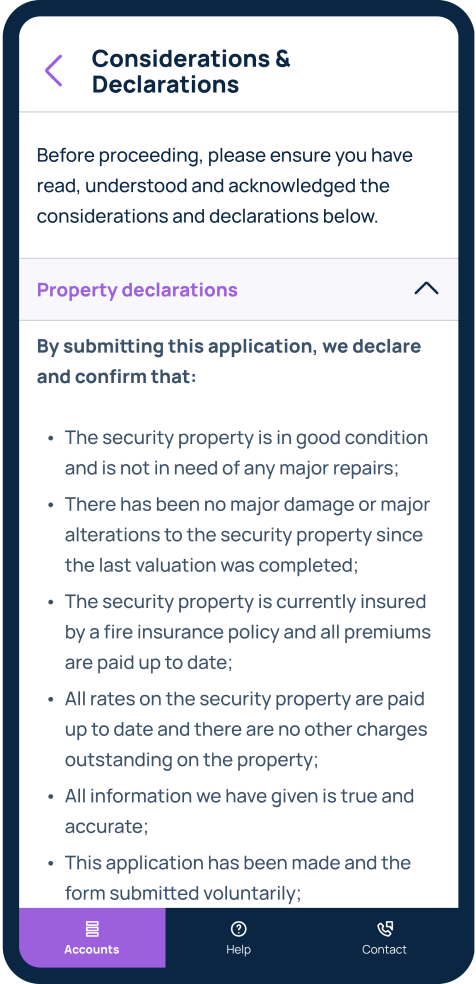

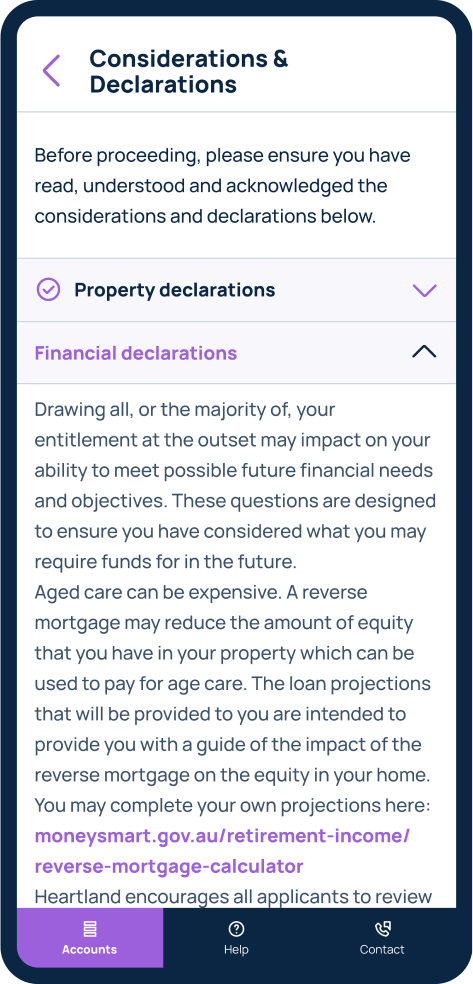

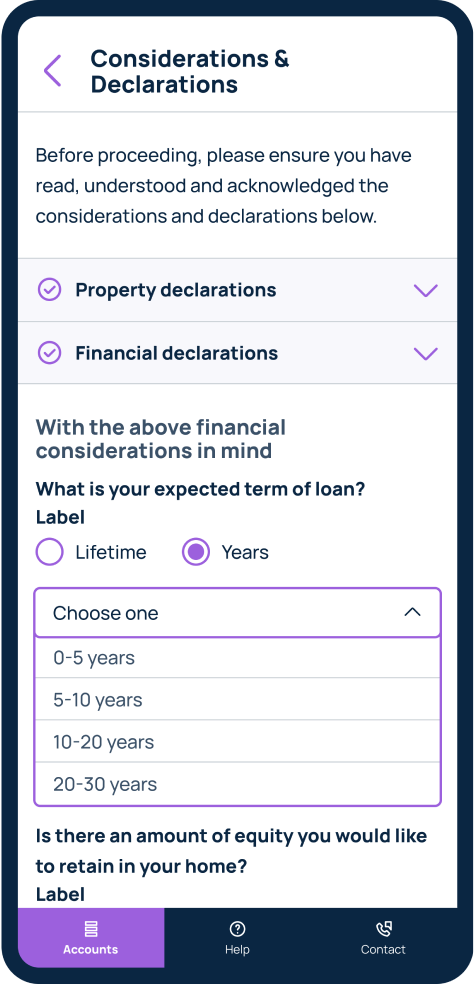

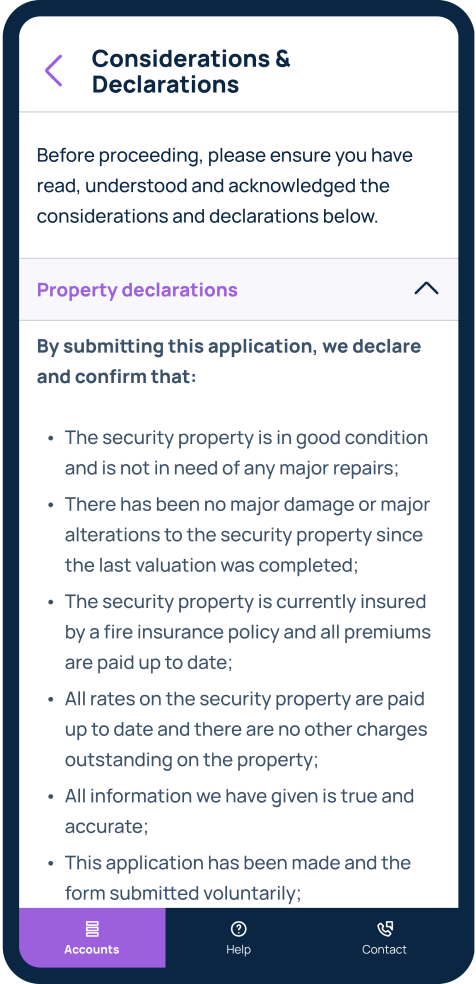

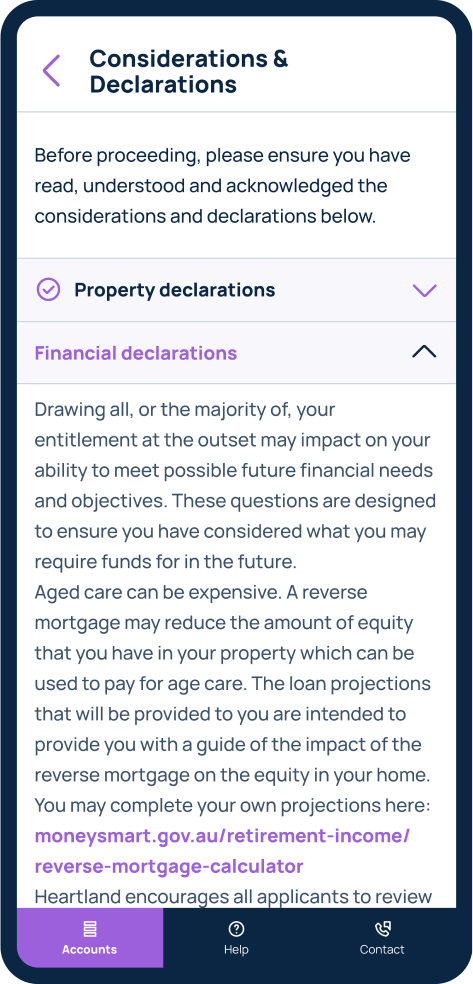

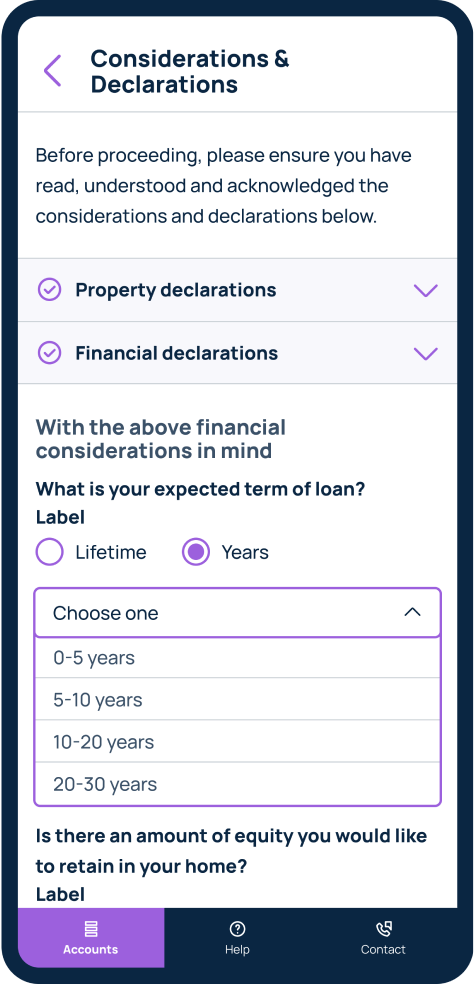

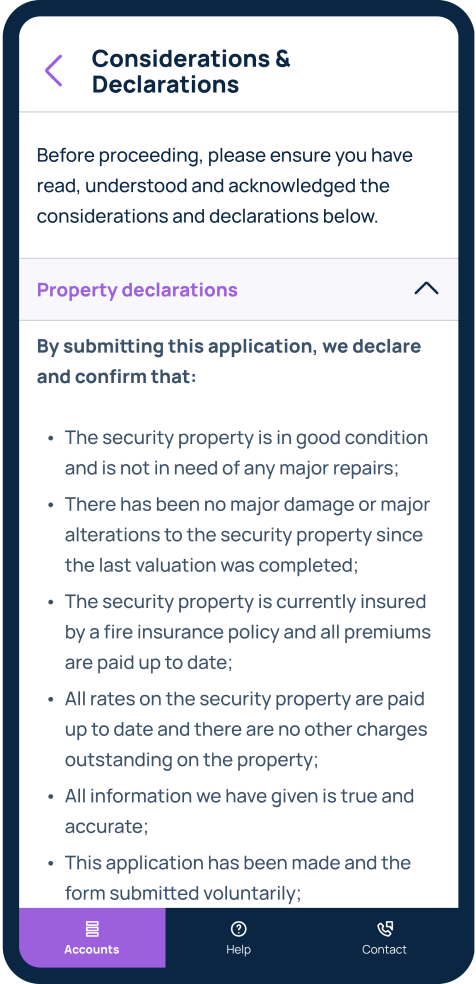

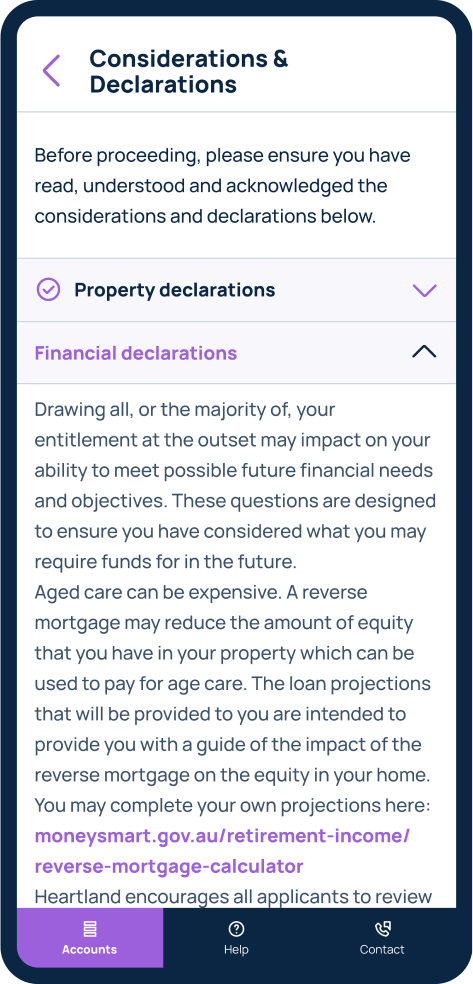

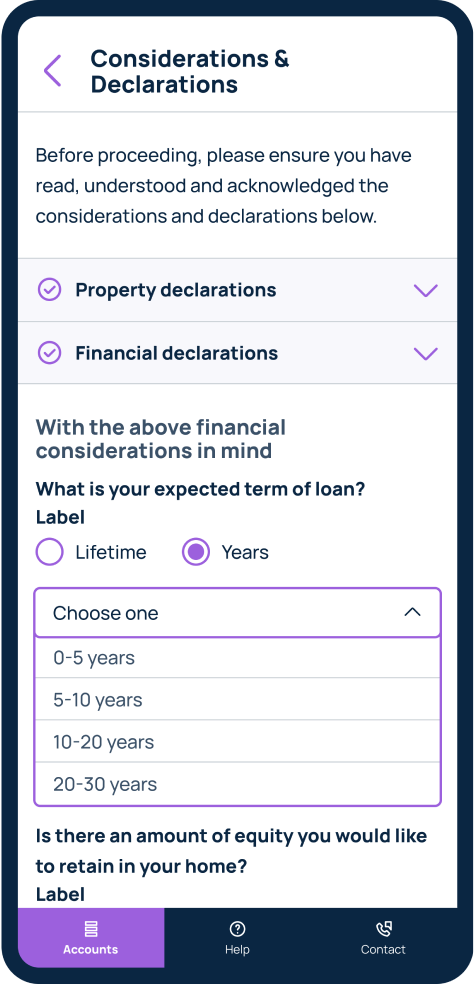

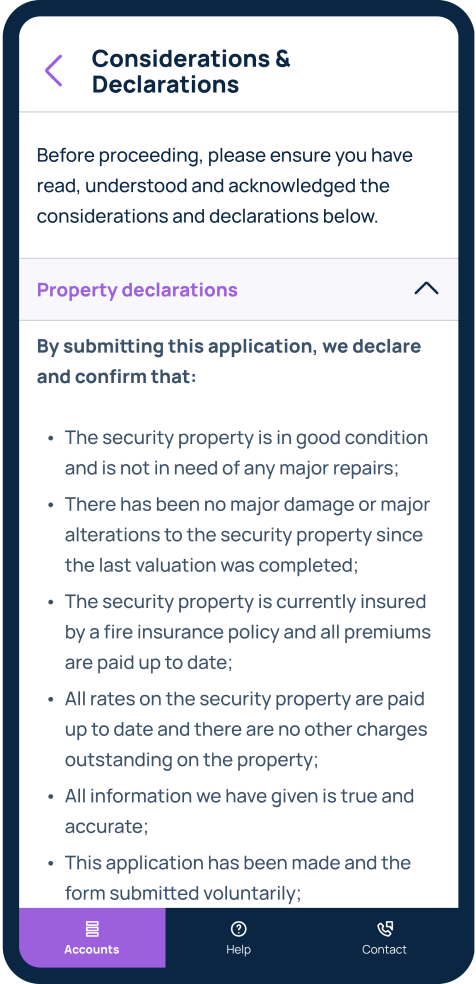

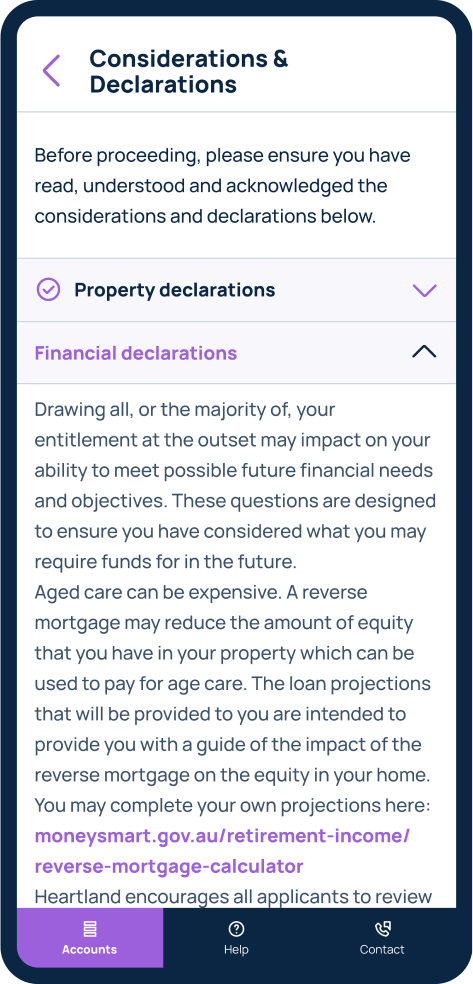

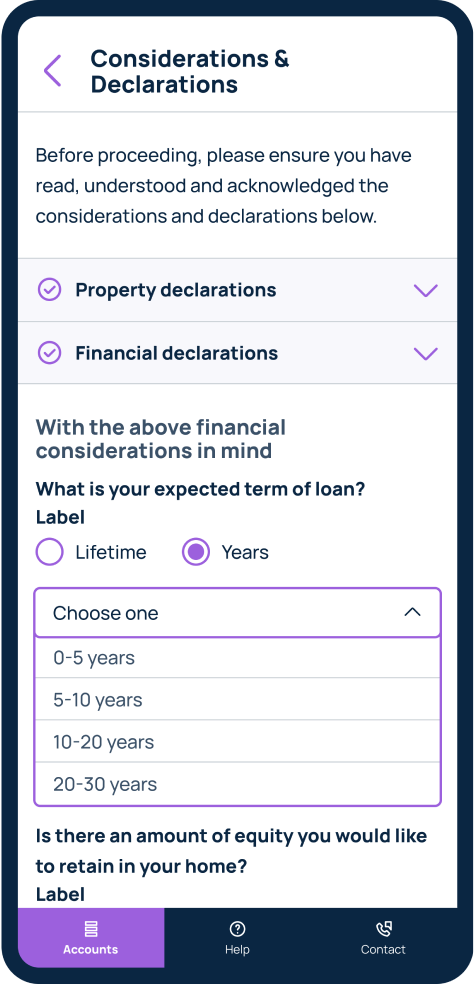

On the next page, read and agree to the property declarations and financial considerations, confirm your expected term of loan and any equity you wish to remain in the property.

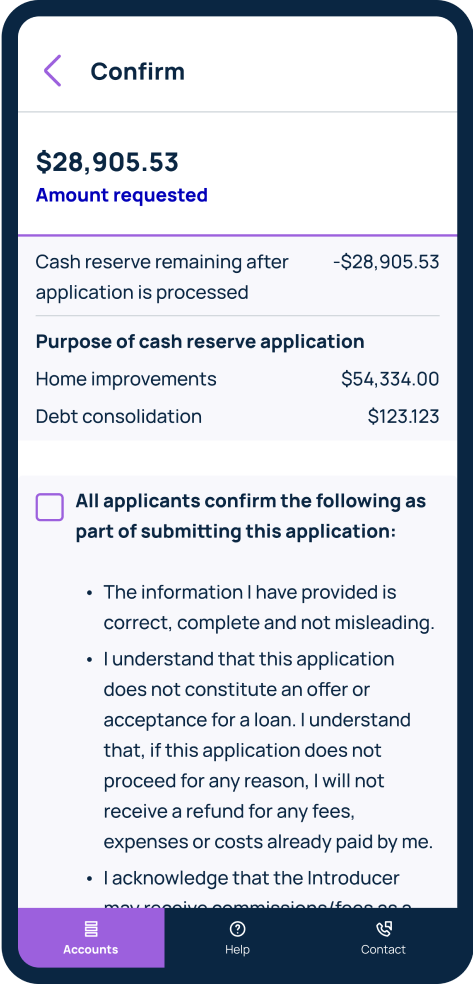

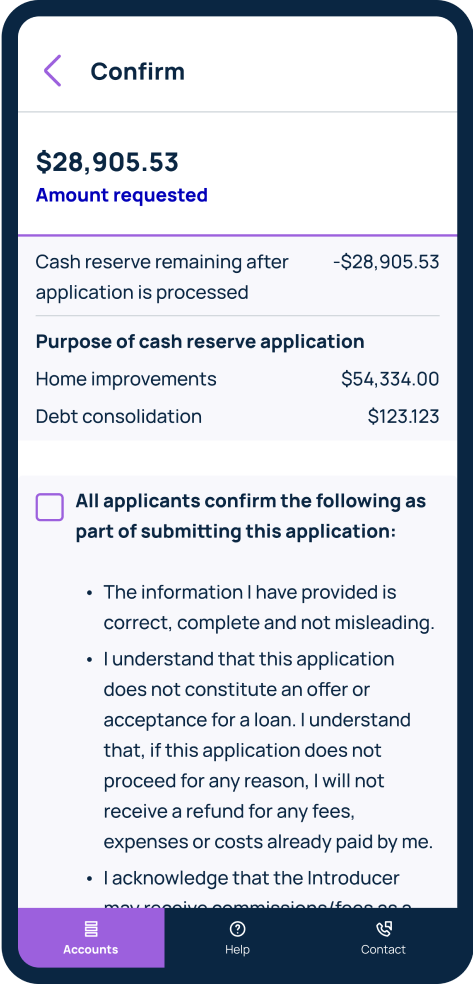

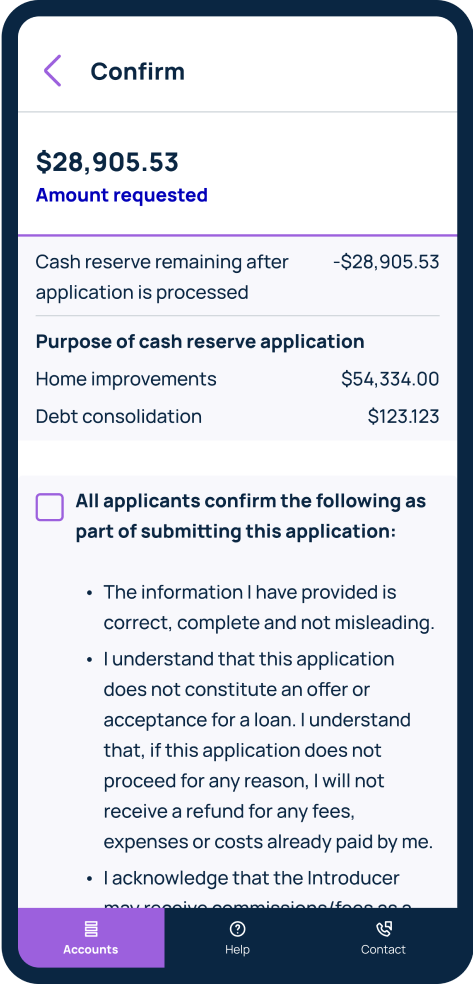

Finally, you can review your application and acknowledge the remaining declarations and consents including reading and understanding the Reverse Mortgage Information Statement and ASIC’s MoneySmart Reverse Mortgage calculator projections. You can then continue to submit your application.

On the next page, read and agree to the property declarations and financial considerations, confirm your expected term of loan and any equity you wish to remain in the property.

Finally, you can review your application and acknowledge the remaining declarations and consents including reading and understanding the Reverse Mortgage Information Statement and ASIC’s MoneySmart Reverse Mortgage calculator projections. You can then continue to submit your application.

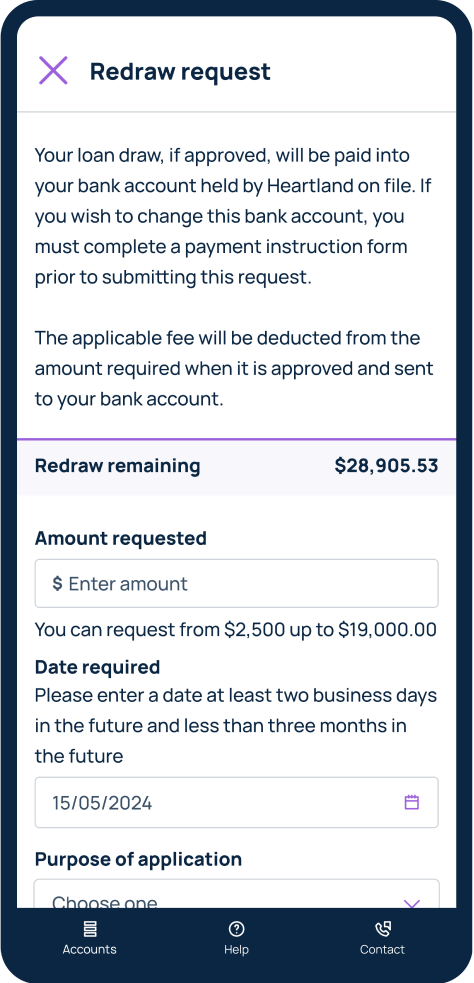

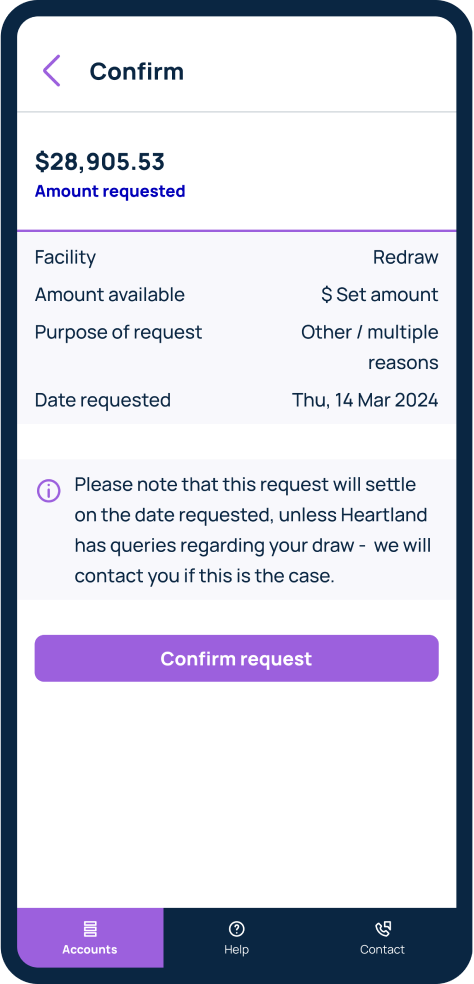

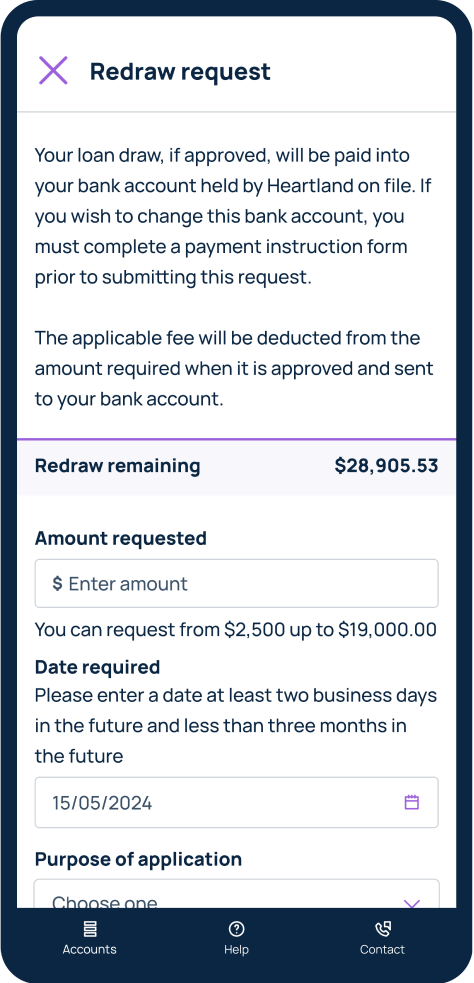

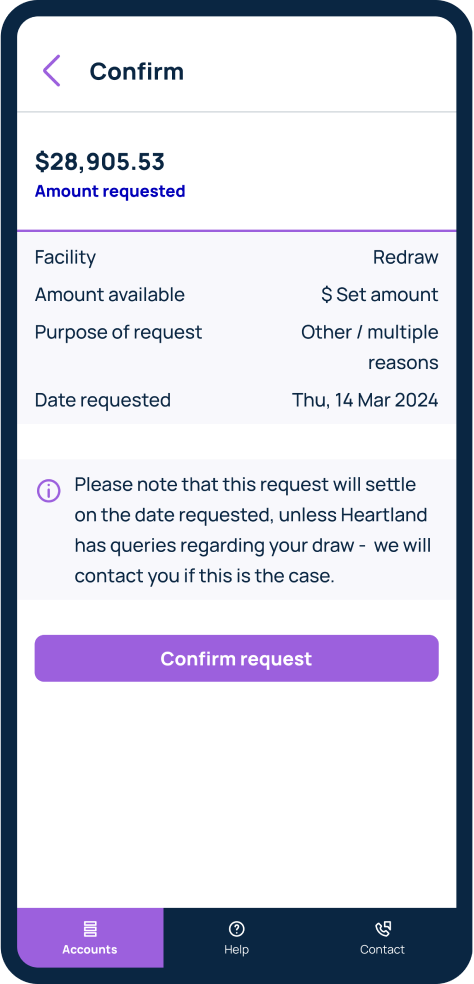

Apply for redraw

Apply for redraw

Within your loan account, a button to request an amount from your redraw will show below your loan details.

Click on this button and enter the details of your request including the amount required, date required, and purpose of request.

Ensure you have clicked on and agreed to the declaration and acknowledgement, then continue to review and confirm your request.

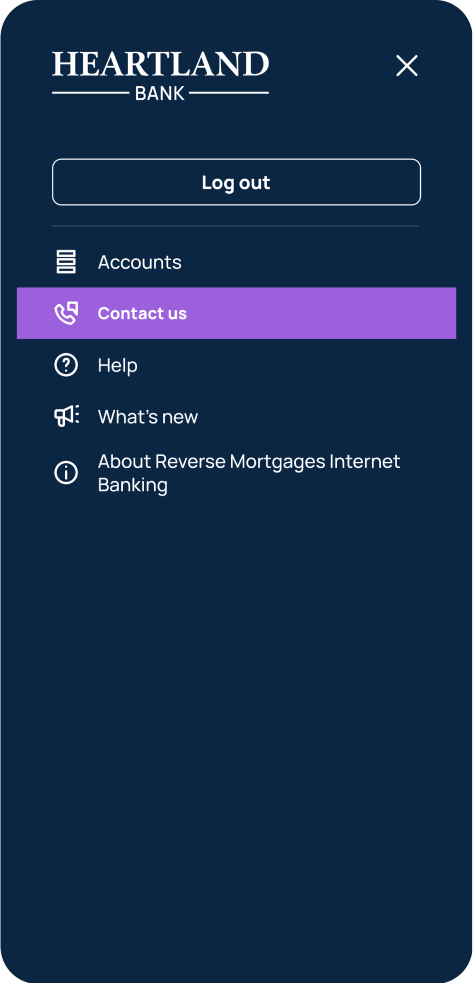

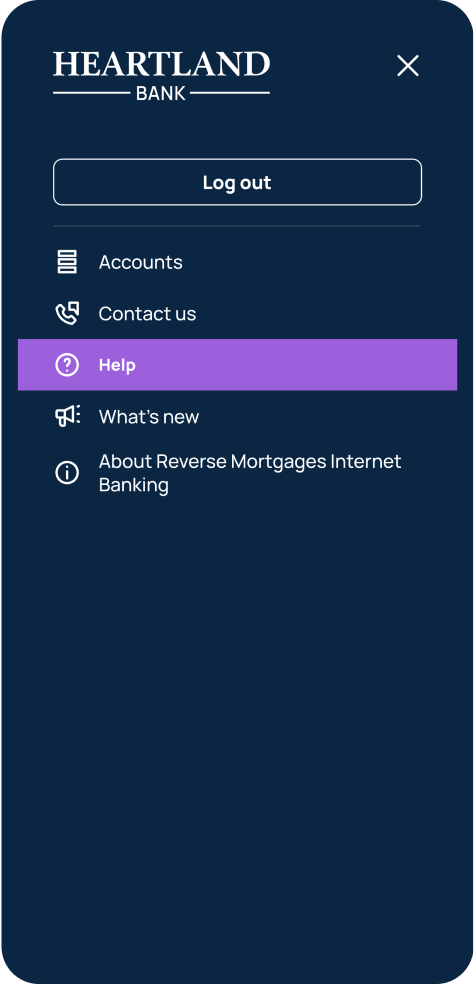

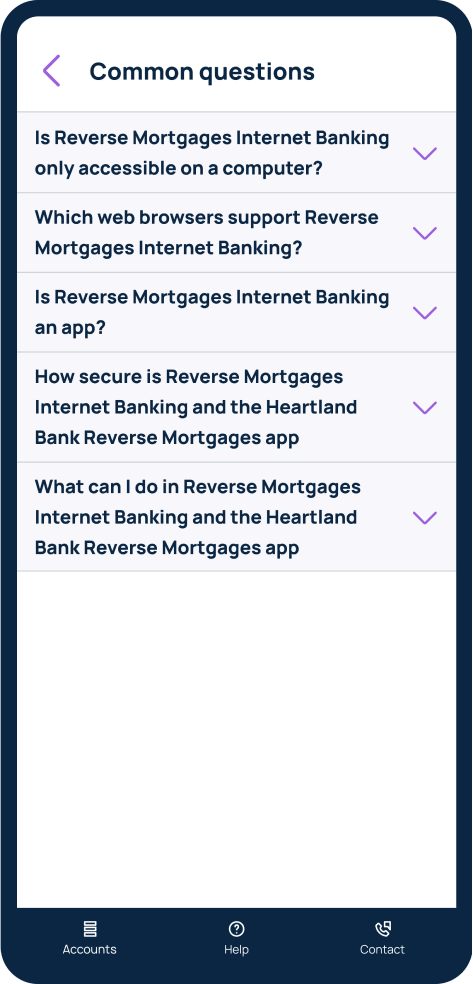

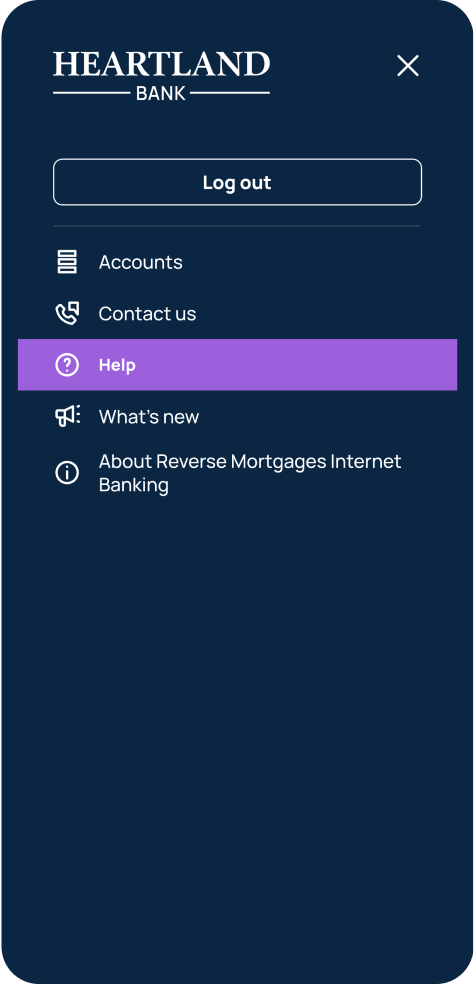

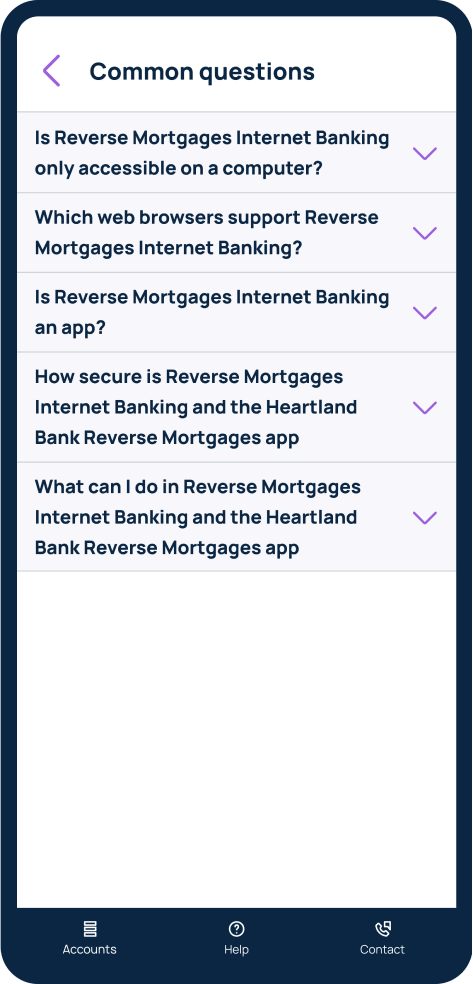

Find answers to common questions

Find answers to common questions

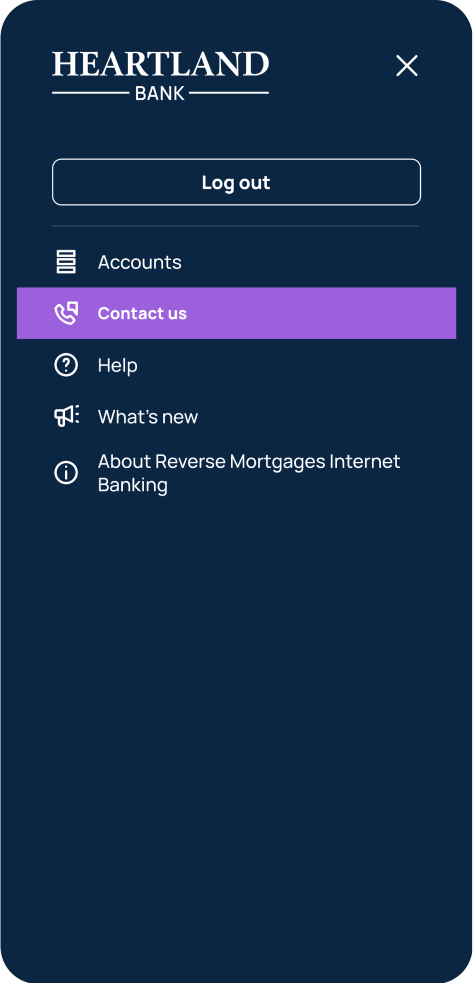

Click the 'menu' tab in the top left corner and select 'help'. Here, common questions and answers will appear.

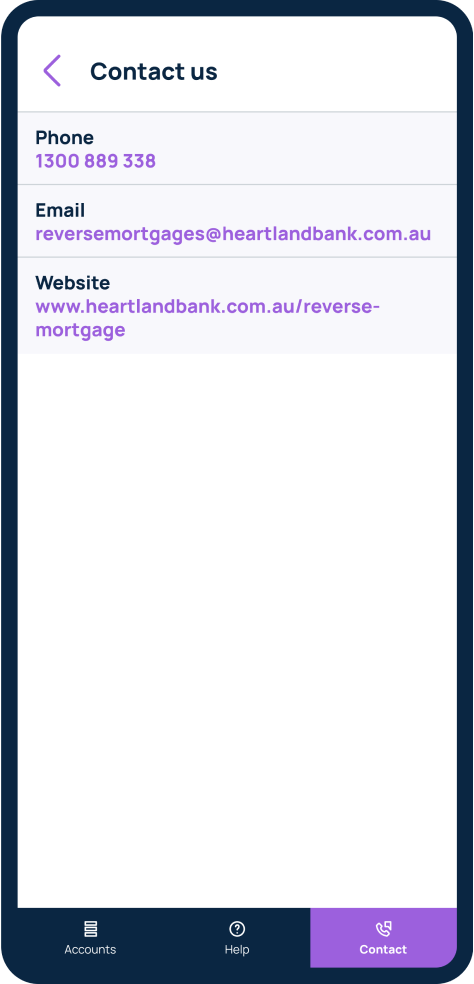

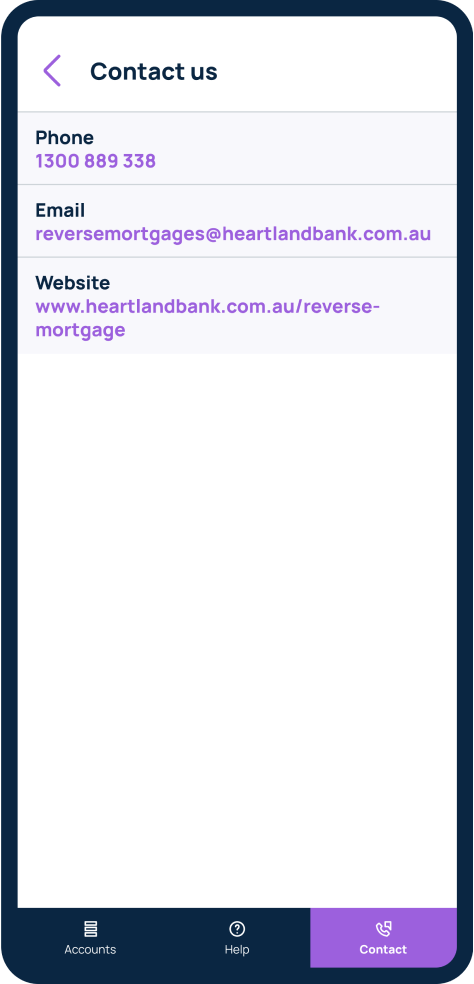

Find contact details to reach our team

Find contact details to reach our team

Click the 'menu' tab in the top left corner and select 'contact us'. Here you will find our contact details should you need to get in touch.