Case studies

Jo and John

Property valued at $500,000. Both 70 years old...

Show more

Show more

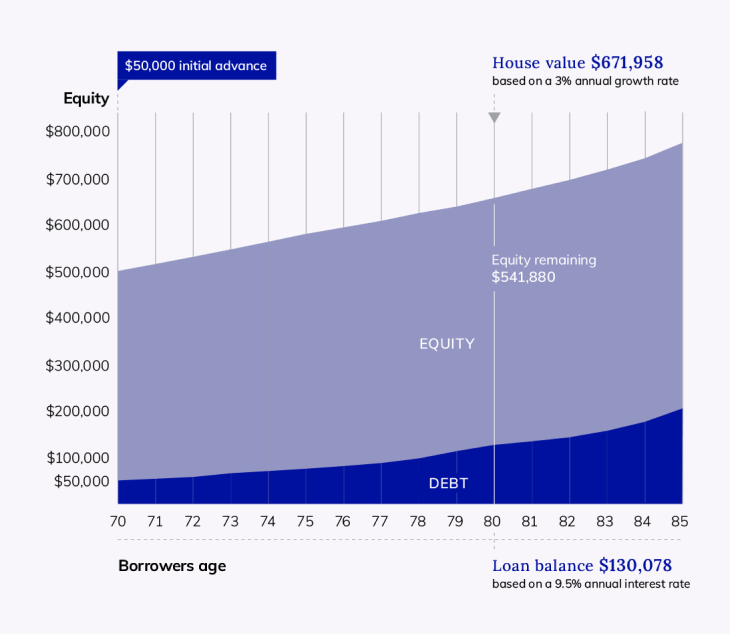

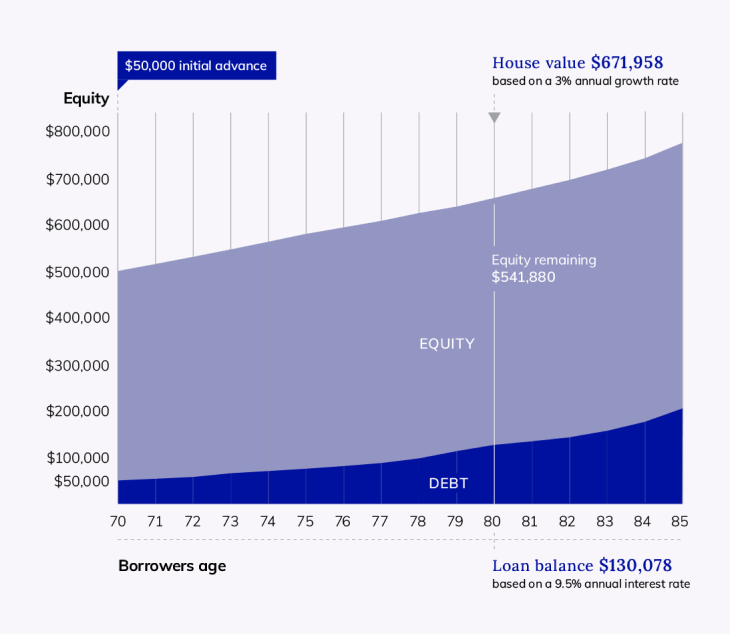

They began looking into reverse mortgage options and applied with Heartland. The maximum amount available to them is $150,000. Initially, they chose to draw down $50,000 for home improvements, with the option to apply for a cash reserve in future. The cash reserve is never applied for.

The graph below shows what could happen to their equity over time. As you can see, while the loan debt increases, so does the value of their property, and the amount of equity increases as a result.

In dollar terms, Jo and John could have more ‘net equity’ after 10 years than what they did before the loan, about $541,880 of the home value.

After 15 years, when they are both 85 years old, there could still be $570,207 remaining.

See how we can help with home improvements here

*The graph above is for illustrative purposes only and assumes a 9.5% interest rate and 3% property growth for the term of the loan, with no voluntary repayments made or additional fees charged. Interest rates are variable and may change from time to time. Current interest rates and fees can be found in Heartland’s Fee Schedule. There is no assurance that property values will increase over time, and property values may also decline. Applications are subject to application, valuation and credit criteria.

The graph below shows what could happen to their equity over time. As you can see, while the loan debt increases, so does the value of their property, and the amount of equity increases as a result.

In dollar terms, Jo and John could have more ‘net equity’ after 10 years than what they did before the loan, about $541,880 of the home value.

After 15 years, when they are both 85 years old, there could still be $570,207 remaining.

See how we can help with home improvements here

*The graph above is for illustrative purposes only and assumes a 9.5% interest rate and 3% property growth for the term of the loan, with no voluntary repayments made or additional fees charged. Interest rates are variable and may change from time to time. Current interest rates and fees can be found in Heartland’s Fee Schedule. There is no assurance that property values will increase over time, and property values may also decline. Applications are subject to application, valuation and credit criteria.

David and Margaret

Property in Melbourne valued at $1,000,000. Ages 63 and 72...

Show more

Show more

They applied for a Heartland Reverse Mortgage to repay $33,000 of outstanding debt, $25,000 of home improvements and an extra $2,000 to cover their solicitor and some other small costs, making up a total initial advance amount of $60,000.

They also wanted to use their reverse mortgage to supplement their income, so they applied for a regular advance of $1,500 per month for 5 years, totaling $90,000. They also had the option to apply for a cash reserve for future needs or unexpected expenses, subject to approval and a loan agreement.

They were able to borrow the total amount requested as it met Heartland’s credit criteria, with the condition that they refinance their debts on settlement.

Their Heartland Reverse Mortgage helped them to support ongoing income, and removed the requirement to make regular loan repayments on outstanding debt, helping them to manage their cash flow more easily.

See how we can help with day-to-day expenses here

They also wanted to use their reverse mortgage to supplement their income, so they applied for a regular advance of $1,500 per month for 5 years, totaling $90,000. They also had the option to apply for a cash reserve for future needs or unexpected expenses, subject to approval and a loan agreement.

They were able to borrow the total amount requested as it met Heartland’s credit criteria, with the condition that they refinance their debts on settlement.

Their Heartland Reverse Mortgage helped them to support ongoing income, and removed the requirement to make regular loan repayments on outstanding debt, helping them to manage their cash flow more easily.

See how we can help with day-to-day expenses here

Fred

Unit in Gosford valued at $383,000. Age 71 years old...

Show more

Show more

He applied for a Heartland Reverse Mortgage for home improvements valued at $45,000, and requested $20,000 to use for travel, in total requesting $65,000 as an initial advance.

He also had the option to apply for a cash reserve for future needs or unexpected expenses, subject to approval and a loan agreement.

How much could he borrow?

Fred’s reverse mortgage enabled him to complete the home improvements he was hoping for, so he was able to live in his home comfortably, for longer, enjoying the renovation he had been planning.

See how we can help with home improvements here

He also had the option to apply for a cash reserve for future needs or unexpected expenses, subject to approval and a loan agreement.

How much could he borrow?

71 (age) = 31% LVR (maximum potential loan)

31% (LVR) x $383,000 (home value) = $118,730.

Fred was able to borrow the total amount requested as it met Heartland’s credit criteria, with the condition that he refinance their debts on settlement.

31% (LVR) x $383,000 (home value) = $118,730.

Fred’s reverse mortgage enabled him to complete the home improvements he was hoping for, so he was able to live in his home comfortably, for longer, enjoying the renovation he had been planning.

See how we can help with home improvements here

Bruce and Jane

Property in Bankstown valued at $735,000. Ages 73 and 72 years old...

Show more

Show more

They applied for a Heartland Reverse Mortgage to consolidate $10,000 of debt, pay for home improvements valued at $20,000, everyday expenses of $5,000, a new car for $25,000, and $60,000 for a strata levy. Their total initial advance request was $120,000.

They also had the option to apply for a cash reserve for future needs or unexpected expenses, subject to approval and a loan agreement.

How much could they borrow?

Jane was the youngest borrower, so we took her age when completing the calculation.

See how we can help with buying a car here

They also had the option to apply for a cash reserve for future needs or unexpected expenses, subject to approval and a loan agreement.

How much could they borrow?

Jane was the youngest borrower, so we took her age when completing the calculation.

72 (age) = 32% LVR (maximum potential loan)

32% (LVR) x $35,000 (home value) = $235,200

They were able to borrow the total amount requested as it met Heartland’s credit criteria, with the condition that they refinance their debts on settlement.

32% (LVR) x $35,000 (home value) = $235,200

See how we can help with buying a car here

James

Property in Newcastle valued at $400,000. Age 81 years old...

Show more

Show more

He applied for a Heartland Reverse Mortgage to cover a range of his retirement needs. This included $15,000 to purchase a car, $30,000 for home improvements, $15,000 for travel/holiday, $20,000 for day-to-day expenses, and a further $20,000 for some outstanding debts he wished to consolidate. His total initial advance was $100,000.

He also requested a regular monthly advance of $3,456 for 1 year, totalling $41,472.

The total loan amount requested was $141,472.

How much could he borrow?

Fred’s reverse mortgage enabled him to complete the home improvements he was hoping for, so he was able to live in his home comfortably, for longer, enjoying the renovation he had been planning.

See how we can help with travel here

He also requested a regular monthly advance of $3,456 for 1 year, totalling $41,472.

The total loan amount requested was $141,472.

How much could he borrow?

81 (age) = 41% LVR (maximum potential loan)

41% (LVR) x 400,000 (home value) = $164,000

Fred was able to borrow the total amount requested as it met Heartland’s credit criteria, with the condition that he refinance their debts on settlement.

41% (LVR) x 400,000 (home value) = $164,000

Fred’s reverse mortgage enabled him to complete the home improvements he was hoping for, so he was able to live in his home comfortably, for longer, enjoying the renovation he had been planning.

See how we can help with travel here

Sue

Property in Melbourne valued at $1,220,000. Age 89 years old...

Show more

Show more

She applied for the Heartland Reverse Mortgage Aged Care Option to cover the Refundable Accommodation Deposit (RAD) at an aged care facility for $450,000.

Sue also applied for a regular monthly advance of $4,075 for 2 years, totalling $97,800, to assist with ongoing care expenses. She also had the option to apply for a cash reserve for future needs or unexpected expenses, subject to approval and a loan agreement.

How much could she borrow?

See how we can help with aged care here

Sue also applied for a regular monthly advance of $4,075 for 2 years, totalling $97,800, to assist with ongoing care expenses. She also had the option to apply for a cash reserve for future needs or unexpected expenses, subject to approval and a loan agreement.

How much could she borrow?

89 (age) = 49% (maximum potential loan)

49% (LVR) x $1,220,000 (home value) = $597,800

Sue was able to borrow the total amount requested as it met Heartland’s credit criteria.

49% (LVR) x $1,220,000 (home value) = $597,800

See how we can help with aged care here

Charles

Property in Western Australia valued at $300,000. Age age 72....

Show more

Show more

He applied for a Heartland Reverse Mortgage to cover home care fees plus ongoing income and other needs of $30,000 for the year and wished to pay this monthly using our regular advance option. This is the total loan amount requested.

How much could he borrow?

See how we can help with home care here

How much could he borrow?

72 (age) = 32% LVR (maximum potential loan)

32% (LVR) x $300,000 (home value) = $96,000

Charles was eligible to borrow a total of $96,000 (as his application and valuation met Heartland’s credit criteria) which meant we could lend the $30,000 he requested for home care fees plus ongoing income and other needs paid to him in 12 monthly instalments of $2,500. He ended up deciding to extend this to 2.5 years, so the loan totalled $75,000. This has enabled him to live in his own home for longer than he may have been able to without the ongoing home care and financial support.

32% (LVR) x $300,000 (home value) = $96,000

See how we can help with home care here

Get in touch

If you'd like to find out more about a Heartland Bank Reverse Mortgage, request a guide or call us on 1300 889 338.

Contact us