MySavings account

Maximise your savings

Help reach your savings goals with our MySavings account. You'll enjoy the freedom of no minimum balance, no monthly deposit requirements, and no account-keeping or online transaction fees.

All the good stuff

Competitive interest rate tiers

Tier 1

$0 to $300,000

Tier 2

$300,000.01 to $2,000,000

Tier 3

Greater than $2,000,000

How to open a MySavings account

New customers

1. Open an account

If you’re a new customer, you can open an account online

here.

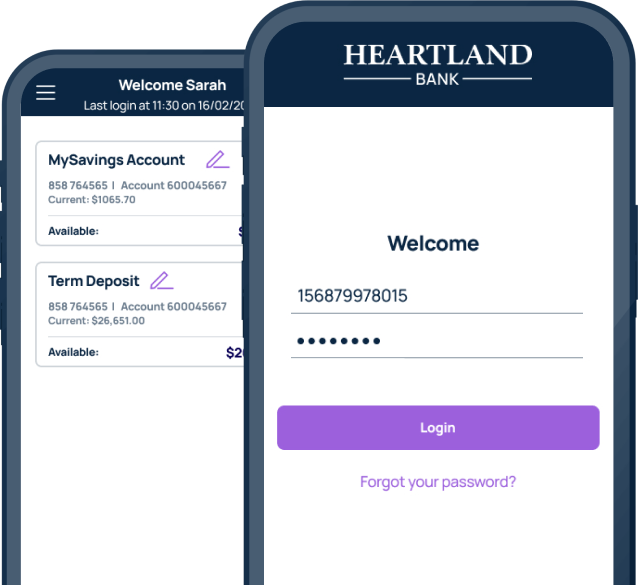

2. Set up your login details

We’ll send you a text message with a one-time password, and an email with your user ID.

Use these details to log in to

Internet Banking

or the Heartland Bank Australia app and set your password.

3. Start saving

Transfer funds into your new account and watch your savings grow!

Existing deposit customers

1. Open an account

Simply log in to

Internet Banking

or the Heartland Bank Australia app and open an account in just a few clicks.

2. Start saving

Transfer funds into your new account and watch your savings grow!

Existing Reverse Mortgage customers

1. Open an account

If you have a reverse mortgage with us, you can open a MySavings account online

here

and select ‘new customer’.

2. Set up your login details

Your MySavings account is managed through a separate

Internet Banking

platform and mobile app that is optimised for savings accounts and term deposits.

This means you'll receive a new login that is independent of your reverse mortgage login.

Once your MySavings account is open, we'll send you a text message with a one-time password and an

email with your user ID. Use these details to log in to the new

Internet Banking

platform or download the Heartland Bank Australia app and update your password.

3. Start saving

Transfer funds into your new account and watch your savings grow!

Download the Heartland Bank Australia app today

Questions? We have answers

Who is eligible to open a MySavings account?

- be 14 years or older

- have an Australian mobile number and a valid email address

- have an Australian residential address, and

- be solely an Australian resident for taxation purposes.

Do you offer same day payments?

The cut-off time for payments made to an account held at another Australian bank or to a registered biller via BPAY is 5.00pm AEST/AEDT. Provided you meet the cut-off time, the payment will generally be received within two business days.

Can I increase my daily payment limit?

For all other payments your default limit will automatically be set to $5,000. If you need to increase this limit, you can do so up to $20,000 through Internet Banking or the Heartland Bank Australia app.

To make payments over $20,000 you'll need to complete an external funds transfer form.

How is interest calculated?

Your daily balance determines which interest rate tier applies. If your balance moves to a different tier, the applicable interest rate will apply to your entire balance for that day - not just the portion within that tier.

For example, if your total balance is $250,000 you'll earn tier 1 interest on the entire balance for that day. If you deposit a further $60,000, your total balance will be $310,000 and you'll earn tier 2 interest on the entire balance for that day.

Interest will be paid on the last calendar day of the month and reflected on your account statement on the first day of the following month.